How to Start a Crypto Hedge Fund

When you start a crypto hedge fund, you get to invest in cryptocurrencies held by affluent investors. Learn strategies and make wise decisions to reap profits.

A Short Guide to Start a Crypto Hedge Fund

A crypto hedge fund relies on the visionary founder and its team of analysts. The performance of the fund depends on its experienced analysts. Anybody can quickly start a fund with an investment group, where you get the opportunity to trade with cryptocurrencies of large quantity.

Cryptocurrencies: Cryptocurrencies are digital currencies that are used to buy goods and services through online transactions. They work on blockchain technology to manage and record transactions. They are considered the currency of the future.

There are more than 1600 listed cryptocurrencies. The most popular cryptocurrencies are Bitcoin, Ethereum, and Ripple’s XRP. There are other altcoins like Litecoin, Binance, Dogecoin, etc. Qualified professional consultation is best for a beginner in cryptocurrency hedge fund investment before making any financial decision.

High Risk, High Return: Digital currency hedge funds carry higher risks than any other traditional investment. Prices are highly volatile, which means that you have the potential to make a lot of money quickly. They help to make money fast as returns are high, which draws in more investors.

Attractive: Crypto hedge funds seek to attract market participants such as institutional investors and third-party custodians. The volatile swings in the crypto market help in getting good returns. Bitcoin, the world’s largest cryptocurrency, is gaining importance in the crypto market. The largely volatile cryptocurrency has achieved a high percentage growth, which has made it most attractive to investors.

Learn the Basics to Manage Crypto Hedge Fund

Start a hedge fund to be your boss, to manage your funds, and to be profitable. Expose your investors to the crypto market to maximize profits. You don’t have to register your fund as there are no strict regulations. In case it is a private partnership, your investors will be your limited partners. Before starting a crypto fund, you have the right to know more about cryptocurrencies and investments. Protection and security are equally important.

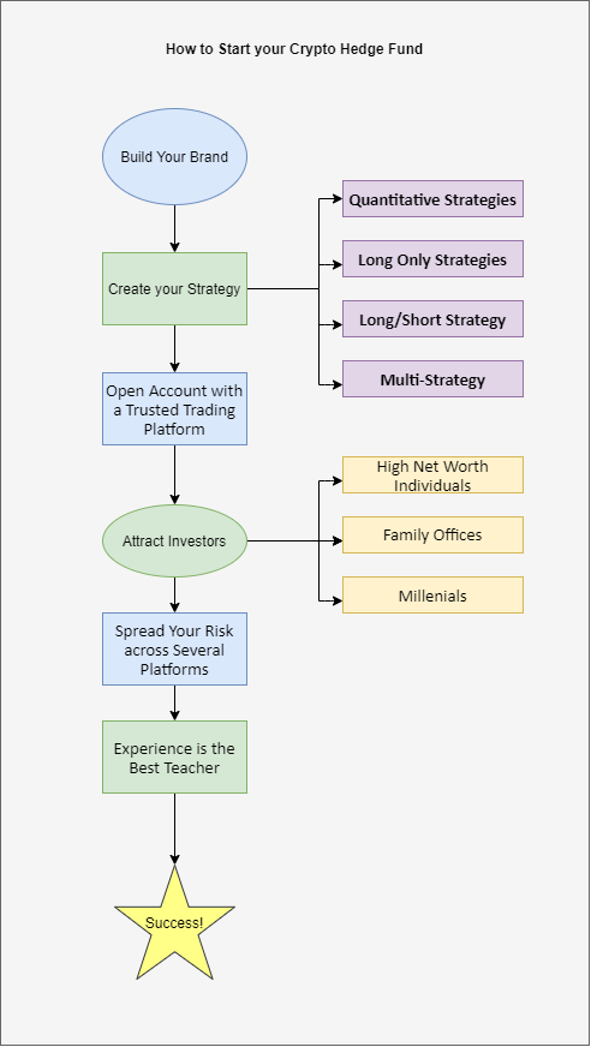

- Create a Reliable Brand Name: Build a good brand name and image. It should reflect trust and credibility in the crypto world. Once it gains prominence, you will earn reliable investors. Use the term “capital” or “investments” to your name so that the company is easily recognizable as a finance company. Be reliable.

- Have a Strong Strategy: Establish what your firm wants to achieve for investors, set goals, and take steps to achieve that goal. Use various marketing strategies, and set a formal plan with tangible goals. Potential investors prefer to know more about your company, your risk management policy, and your process before investing in your hedge fund.

There are several strategies available to manage risk. The “Buy and hold” strategy is a popular strategy that is most rewarding. Books, podcasts, and courses (online or in-office) provide a better understanding of market conditions to manage risks. But experience is the best teacher.

- Open Account with a Trusted Trading Platform: Start your hedge fund by first opening an account with a trusted platform, such as Coinbase, as it makes it easy to buy cryptocurrencies like Bitcoin, Ethereum, and Litecoin. Trusted platforms like Coinbase have a large user base and provide a sophisticated infrastructure and a trusted security system.

Once you open an account on the Coinbase website, you can use your bank account in fiat or a credit card to purchase cryptocurrencies.

- Spread Your Risk across Several Platforms: Make sure that you spread your risk across several platforms. It will protect you in case of hacks. Risk management is essential.

Binance is a cryptocurrency exchange that has a focus on the Chinese markets. It has many Chinese and English users. Digital currency hedge funds can operate riskier strategies than traditional funds.

Bittrex is a prominent crypto exchange that trades in several cryptos such as Bitcoin, Litecoin, Nextcoin, and Darkcoin. There are many more good platforms.

- Experience is the Best Teacher: Gain experience by doing research and applying strategies. Analysis and study of market situations will help you make the best use of your fund amount.

- Be Successful: To be successful, you need expert advice. With experience and knowledge, your profits will increase tremendously. You can reward your investors with handsome returns. Ensure that you maintain your accounts and pay taxes accordingly.

Types of Crypto Hedge Funds

There are two common types of crypto hedge funds.

- To manage your portfolio, that deals exclusively in cryptocurrency.

- To manage your portfolio that adds cryptocurrency along with other asset types.

Crypto Hedge Fund Trading Strategy

There are various fundamental and quantitative investment strategies that you should follow when you start a crypto fund fx. Take advantage of the swing in prices caused by volatility in the value of cryptocurrencies.

- Quantitative Strategies: Price volatility can be exploited to take a directional or a market-neutral approach. Indicative strategies are arbitrage, low latency trading, and market-making. Here liquid cryptocurrencies are traded.

- Long Only Strategies: When investors have a long-term investment horizon, the funds are used in early stake token projects. The lock-up period for such funds is the longest.

- Long/Short Strategy: Crypto-specific strategies such as long/short, event-driven, relative value, etc., are chosen. Example: Mining is a crypto-specific strategy.

- Multi-Strategy: There are various investment strategies with multiple benefits. They help to reduce volatility and provide smooth returns. It reduces the risk of using a single strategy, as it may lower the asset class’s value. It is said to be the most profitable.

Fund Utilization by Cryptocurrency Hedge Fund

Learn the basics of cryptocurrency and hedge funds before starting a cryptocurrency hedge fund. Use a wide range of strategies to generate returns for investors. Apply technical analysis to understand market movements and use various types of trading such as day, swing, and position. Crypto funds like bitcoin are used for purposes other than for investment. As high net worth clients are willing to take calculated risks on their investment, they like to invest in cryptocurrencies.

In staking, lending, and borrowing, the crypto is moved out of the holder’s wallet into the company’s wallet. Proper utilization plays a vital role in investment decision-making for cryptocurrency investors. As it is an unregulated sector, the crypto market offers opportunities like no other asset class.

- Staking: it helps to secure a network. Investors reap benefits by locking up assets essential for network protocols. It involves yield-based strategies that contribute to the stability of the network.

- Lending: Investors can earn interest passively. You can lend your crypto to traders and earn interest from it. Crypto exchange platforms allow lending and margin trading features to customers, such as arbitrage interest rates and flash loans.

- Borrowing: You can borrow cryptocurrencies to have funds in a core position.

However, staking, lending, and borrowing have their pitfalls. If the network value drops suddenly or becomes less popular, your asset value will also fall.

Investor Types in Crypto Hedge Funds

Most investors in crypto hedge funds are high net-worth individuals and family offices. The cryptocurrency market is highly volatile, and the downside risks of the asset class are also high. There is global interest in investing in digital assets. Ultra-high net worth clients and family office clients prefer to construct a strong portfolio in the crypto market. Volatile swings are exploited to extract maximum returns, which attracts new investors into the crypto space.

Most millennials show a preference for cryptocurrency investment rather than traditional banks. Hedge funds provide the perfect ground for crypto investors.

Early cryptocurrency investors have become millionaires by growing healthy financial portfolios. More people are ready to invest their money into the cryptocurrency market. Investors are signalling profitable growth in cryptocurrency prices. Investors are still unsure of the large volatile swings in the crypto market. They prefer to invest safely into an excellent digital currency hedge fund. Many first-time investors are entering the crypto world.

Fee Structure

Crypto hedge funds raise revenue on the fees charged to investors. Fee structures are not easy to understand as it involves much tax documentation. The fee charged helps to cover the costs involved in running the hedge fund. When investments yield high profits, your client will be willing to pay the price charged.

- The management fee is charged as an upfront fee on every dollar invested. It is used to cover the running costs of the hedge fund.

- Incentive fees are applied to profits. They are higher than management fees, as it is a reward for the product’s performance. When the right strategy is used, the investment returns are high. It improves investor trust, and the investor will have no issues with paying the hedge fund fee.

The crypto market is a very volatile market that has to be actively managed, similar to your portfolio. Have an overall vision for your crypto hedge fund, generate returns for investors. Invest well, reap profits, reward your investor, and earn your fee. You can reap good money on the fee charged.

Pros and Cons of Starting a Digital Currency Hedge Fund

Pros: Investing in a digital currency hedge fund gives you the potential to earn high returns. There is diversification and high liquidity. It allows for international transactions as cryptocurrencies can be sent to any nation without any geographical limitation. It involves a high level of security as every transaction uses blockchain technology. Once you learn the right strategy, you can easily make quick money, as the market is volatile and fluctuating. Day, swing, and positional trade give high returns.

- Have the potential to earn high returns as cryptocurrencies are volatile that allows for big profits. Prices rise and fall at a rapid rate.

- It allows for international transactions.

- It is easy to open a digital currency hedge fund as there are no strict regulatory controls.

- As it uses Blockchain technology, it requires a high level of security.

- When you earn the trust and credibility of your customers, your name will gain prominence.

- It involves family offices and high-net-worth individuals. You will have affluent clients who are willing to invest in the crypto market.

Cons: There is a lack of proper regulatory control over cryptocurrencies. Many issues associated with crypto investments arise, as they are considered speculative and high-risk assets. Just as investors can make money easily, they can also lose the capital invested. You must understand that starting a cryptocurrency hedge fund is risky as speculative investments are very volatile.

- There is a lack of transparency and security.

- While investing in cryptocurrency hedge funds, make sure that you invest money that you can afford to lose, as there are risks associated with crypto investments.

- Institutional investors are wary of crypto as they are usually volatile.

- As high-net-worth individuals are investors, the digital currency hedge fund should have a net worth of at least $100k. Only then can you handle portfolios of accredited investors.

Crypto Asset Hedge Fund Regulations

Cryptocurrency markets have a frenzy of investment activities. Traditional investors are also attracted to cryptocurrencies. The highly speculative crypto market is drawing more crowds. Popular cryptocurrencies like bitcoin and ether are considered commodities rather than securities, and hence they fall outside the securities regulations.

As there is no regulatory guidance, it is unnecessary to register if the fund manager makes an outright cryptocurrency purchase. If the fund manager buys cryptocurrency with leverage, margin, or a futures contract, it must be registered.

Investment in cryptocurrency hedge funds consists of risks higher than that of traditional hedge funds. Regulators across the globe lay stress on investor protection. So, knowing the risks involved in digital currency hedge funds is necessary before investing hard-earned money. Have a solid accountant to do the required accounting. Declare the right amount of tax in the jurisdiction you are in.

Pointers for Crypto Enthusiasts

- Do not share private keys with anyone.

- New crypto tokens are constantly introduced. You should be aware of the founders behind the crypto and investigate the risks before investing in them.

- Investors should keep their money invested for a longer duration to enjoy benefits.

- Ensure that hedge funds provide essential information on their website on credibility and capability. Investor interest increases when transactions are transparent and profitable.

- Investors should understand different strategies applied by hedge funds on their investments. Investors prefer methods that they understand to processes that are complex or unclear.

- Read the fine print in the company prospectus before investing in cryptocurrencies. Ensure that it is a legitimate company.

- Gather knowledge about the owner of the company. See if there are other reputed investors who have made investments in the company.

Celebrities and multinationals – Cryptocurrency

The craze for digital assets has increased, thanks to some important public figures who advocate that cryptocurrencies are the future currency. It has now captured the interest of the general public and institutional investments. It is the right time to start a cryptocurrency hedge fund.

- Paul Tudor-Jones, the founder of Tudor Investment Corp., has encouraged investment in the hedge fund sector.

- Elon Musk, the CEO of the electric vehicle Tesla has announced that the company will accept digital currency as payment for its products, and bitcoin prices shot up.

- PayPal had announced that it would allow crypto buying to its wallet, which moved the PayPal and bitcoin prices higher.

- The payment firm Square has stated that cryptocurrency was the instrument for economic empowerment, lending support to the crypto market.

- Square, the payment firm, has announced its support for cryptocurrency. It has been stated that cryptocurrency is the instrument for economic empowerment.

- Visa was the first significant payment processor that accepted cryptocurrency. It allows payment settlements using cryptocurrency.

The cryptocurrency market has a total value of more than $2 trillion. Millionaire investors with investments of high value are attracted to it. However, it is a speculative asset that is considered high-risk. Its chief attraction is its potential to make a lot of money quickly. But it may also lead to deep losses. Take and enjoy profits and reward investors handsomely.

Protect your investor and your crypto hedge fund, or you could just invest in a fund. Speculation is a high-risk activity that can yield high profits and can wipe out your capital too.

Leading UK Cryptocurrency Funds in 2021

Digital tokens are endorsed by high-net-worth individuals and institutions and attract investment inflows. Crypto hedge funds attract investors as they can make a lot of money quickly, especially in the United Kingdom, where investors interested in the crypto market are many.

- CoinShares: It is a London-based hedge fund that helps to monitor crypto investments and the crypto market trends. Leading cryptocurrencies traded are Bitcoin, Ether, Ripple’s XRP, and Litecoin.

- Insula: The hedge fund has its base in London. As an investor, you can register here and purchase, store or transfer your crypto funds. It offers its tokens through a decentralized platform. As a member, you have to pay only 30% as a performance fee. The premium cost is 500 ISLA per annum.

- Crypto Global Management: The London-based fund manages your digital cryptocurrency and portfolio. It provides transparent services and strategies for investment. Investors have the choice to choose their options.

Leading US Crypto Funds in 2021

Crypto hedge funds attract crypto investments as they earn a lot of money very quickly. They are volatile, speculative, and risky investments, and there is a risk of losing money. You need to be aware of the risks that you take. New tokens are constantly being introduced, so be mindful of the founders behind them and the market reaction before investing. Bitcoin retains its gold standard, followed by Ethereum.

- Pantera Capital: Founded in 2013, the fund has been around for several years. It manages the portfolio of big institutional investors and high-net-worth individuals across five cryptocurrency funds.

- Polychain Capital: It was the first fund to manage assets worth around $1 billion in 2018. It includes stable coins and several leading crypto coins.

- The Grayscale Bitcoin Trust (GBTC): Established in 2015, it helps investors build the blockchain ecosystem with a minimum investment of $50,000.

- CoinCapital: It deals in a variety of cryptocurrencies and individual coin offerings, especially Litecoin, Bitcoin, Ethereum, Ripple, and Dash. They cater to individual investors with a net worth of at least $2.1 million.

Best Performing Crypto Currency Funds in 2021

Crypto hedge funds are highly volatile and risky. It is best to do crypto fund research before investing in them. Cryptocurrency prices move up and down due to large swings in value. A look into some popular digital currency hedge funds will make it easier for investments.

- Grayscale: It was founded in 2013 and is the biggest in the world. The assets under management are $10 billion.

- CoinShares: Started in 2014, it is the largest bitcoin investment fund in Europe. The assets managed by them are more than 1 billion.

- Altair Capital: Started in 2010, the capital fund is Israel-based. The assets under management are $400 million.

- 500 Startups: Started in 2010, it is a global venture capital firm that is Silicon-Valley based. It helps to build startups to build global ecosystems.

- Ember Fund: It is a trading app that transforms your phone into a cryptocurrency hedge fund. It provides decentralized trading and self-custody.

- CoinCapital: It attracts individual investors with a net worth of $2.1 million. It invests in many Blockchain startups and cryptocurrencies.

- PolyChain: Started in 2016, it is a US-based cryptocurrency investment management firm. It was the first fund that had more than $1 billion assets under management.

- Crypto Global Management: It is UK’s first portfolio management service in cryptocurrency. It has over three decades of experience in digital technologies.

Profitable Strategies to Manage a Hedge Fund

- You can buy reliable tokens or altcoins. You can take advantage of the large swings in the price volatility of the cryptocurrency and buy at lower levels.

- You can set a pre-determined value for a cryptocurrency. Whenever crypto reaches that level, you can invest at that level. You have to identify such cryptos and their price fluctuations.

- Take advantage of insider information while investing or exiting from the cryptocurrency.

- There is a lot of hype around crypto tokens, leading to a spike or a crash in prices.

Profitable Strategies as a Crypto Investor

- Learn more about the background of the crypto hedge fund background to see if they are genuine. Check when the fund was first founded, as age will add to its reliability.

- See if they are transparent in their dealings. Check through investor reviews and testimonies about their operations and genuineness. Transparency and security are two main factors that an investor should consider before choosing a good crypto fund.

- See if there are other credible investors in the fund.

- Make a comparative analysis of the profit margins with other crypto hedge funds.

Major Cryptocurrencies Traded in cryptocurrency Hedge Funds in 2021

Cryptocurrency is making big news every day. In 2021, significant cryptocurrencies have surged higher in value, beyond investor expectations. It has made early investors in cryptocurrencies into multi-millionaires.

Cryptocurrencies, also called digital currencies, are gaining importance in the financial markets. The crypto market has large fluctuations that provide opportunities to investors and users alike. Cryptocurrencies like bitcoin, Ethereum, and Litecoin continue to make headlines and are preferred by users for their high volatile prices.

Bitcoin (BTC) has a high trading rate in daily trading. Ethereum is another most traded altcoin, followed by XRP, Litecoin, EOS, and Bitcoin Cash. Cryptocurrency hedge funds favour these. Litecoin is one of the top-traded altcoins despite its smaller market cap.

It is easy to start a crypto hedge fund by learning more about cryptocurrencies, the founders behind the token, the price volatility, and market reactions. New crypto tokens are frequently popping up. Learn to identify the next hot ICO or growth coin. Invest in good asset coins and learn to manage them well.

- Bitcoin (BTC): It has a market capitalization of $730 billion. It has been up by more than 100% year to date.

The value of bitcoin in January 2021 was at $31,000, but in March 2021, it reached almost $60,000. It has a high market capitalization and is the most traded cryptocurrency, also known as crypto gold.

- Ethereum (ETH): It has a market capitalization of $300 billion.

Ethereum prices have increased from $1,270 in January 2021 to $2,750 in April 2021.

- Binance Coin (BNB): It has a market capitalization of $59.2 billion.

Binance Coin prices were at $0.002425 in January and reached a high of $0.010840 in April 2021.

- Cardano (ADA): It has a market capitalization of $52 billion.

Cardano prices have gone up from 0.1965 in January 2021 to 2.2773 in May 2021.

- Dogecoin (DOGE): It has a market capitalization of $46.5 billion.

Dogecoin prices have gone up from 0.0079 in January 2021 to hit a high of 0.6875 in May 2021.

- Ripple (XRP): It has a market capitalization of $41.3 billion.

Ripple XRP has moved higher from 0.2261 in January to a high of 1.8297 in April 2021.

- Binance Coin (BNB): It has a market capitalization of $6.8 billion.

It began January 2021 at 0.0012 and traded at a high of 0.0120 in May 2021.

When you get investors who invest in your crypto fund, you have to manage these funds profitably as a crypto hedge fund manager. Once profits multiply, you can make payments from your profit to your investor. It will build up the goodwill of your hedge fund, which attracts more investors.

In the cryptocurrency market in 2021, investors are earning huge returns. Primarily due to surging prices in Bitcoin. Additional investors like Institutional clients and traditional businesses are also attracted to Bitcoin. Crypto hedge funds involve high risk as they seek short-term gains with high profit.