Forex traders implement several forex trading strategies to provide the best chance of profitability through different market cycles in the forex market.

Every trader in the crypto market follows primary forex trading strategies while trading. Apply discipline in your trading approach in leading forex trading platforms. Use the best forex trading strategy that works for you, and accumulate profits. When you learn forex trading, you will learn to study forex charts and analyze the markets for a profitable trade.

What is Forex Trading?

The foreign exchange market, also known as the FX or the forex market, deals with the transaction of currencies between countries. It is the most liquid asset market in the world. The forex market is both a spot market and a derivatives market. Once you know about the forex trading system and how it works, you can start trading. Choose the best trading plan in the forex market.

Currencies are exchanged in foreign exchange markets to facilitate international trade. Traders utilize the price movement in the chosen pairs of currencies and speculate on the price difference to make a profit. It is known as forex trading. Learn forex trading to understand the price movement in the currency pairs. The most-traded currencies are the US Dollar, the Euro, the British Pound, the Japanese Yen, and the Canadian Dollar. Traders prefer to trade on small price movements, known as forex pips, for profitable trading on popular currency pairs.

Let us consider the currency pair such as GBP/USD. The first currency, the British Pound, is the base currency, and the US Dollar is the quote currency.

How to Get Started Forex Trading?

The forex market is affected by many factors, such as the economic strength of the economy, political factors, news, market sentiment, central government policy, etc. Use a proper forex trading plan to implement your forex day trading strategies. The foreign currency exchange is the starting point for all traders to gain forex knowledge through price movements.

Learn the Forex Market

The forex market works similarly to the equity market. It requires specialized knowledge to trade on the forex market. Many online courses teach valuable lessons on the forex market for beginners. Hedging forex will be short-term protection when there is an event that may rock the market trend.

High Liquidity Currency Pairs: As a trader new to the forex trading market, you can choose high liquidity currency pairs such as GBP/USD, EUR/USD, AUD/USD, NZD/USD, USD/CAD, USD/JPY, and EUR/GBP.

Set up an FX brokerage account

Your forex trading journey begins with opening an account with a forex broker. It requires low capital with trading limits. You have to provide your personal information, such as your name, address, email, phone number, date of birth, etc. You can then fund your account and start trading. Start with a limited quantity of money and trade small. It is best to go at a slow trading pace. You have to deposit some funds to cover the cost of your traded currency. Forex options trading protect traders against a loss.

Choose a licensed and regulated broker as they will help protect your funds. With a demo account, using virtual money, you can experiment with various forex day trading strategies, where you gain experience without incurring any risk attached to your investment. Refer to forex trading guides to understand forex market movements.

Understanding FX Market Correlations

Currencies are traded in pairs and are interdependent. You have to understand the correlation between them and determine how they change. It will help you build your portfolio. The higher the correlation, the more aligned they are to each other. Once you understand currency correlation, you can manage your portfolio with better accuracy in accordance with shifting trends. You can experiment with the best forex strategy, along with technical analysis for higher profits. The Daily Forex will keep you updated on the currency correlations through charts, trend analysis, and price predictions.

- A positive correlation is when the currency pair moves in the same direction. The EUR/USD currency pair has a strong correlation.

- A negative correlation is when the currency pair moves in the opposite direction, commonly used in the forex hedging strategy. For example, the AUD/USD currency pair has a negative correlation.

Making Support And Resistance Work For You

Buying at support levels and selling at resistance levels is the best trading method for any trader in the forex market. Forex currency pairs move with an uptrend or downtrend or within a range. Forex action trading system helps traders make decisions on trade based on price volatility. The US Dollar is the basic currency for most currency trades, and economic releases by the United States tend to play a prominent role in the forex currency exchange. Refer to forexnews to identify the support and resistance levels.

Support Levels: When the price of a currency falls or changes direction and begins to rise, it is considered a floor level or support level. It describes how currencies recover or strengthen after falling to low levels. You can buy at this level and enjoy profits as currencies move higher.

Resistance Level: When the price of currencies moves upwards from support levels, they continue to rise to the next support level, which turns into a resistance level. Once the currency pair reaches a high and cannot progress any further, it turns into resistance and weakens from this level. You can sell your position and reap profits.

Support and resistance levels are those zones where levels are pierced or breached, and prices change direction. It is the best forex indicator. With price action trading systems, you can time your entries and exits to get profits.

FX Position Size

While trading on the foreign exchange, your position size plays an important role. Determine the number of lots for trading on the forex market. Choose the size and type of a lot of trade, such as a mini, micro, or standard lot that fits your purse. Your trade size is not too big or small. A standard lot consists of 100,000 units of currency. Choose the best forex strategy for trade. Keep in touch with the trading communities on forexnews to converse with peers and traders just like you.

Set Your Account Risk Limit On Each Trade: You can set a percentage limit on each trade, such as a 1% limit. According to your account size, you can set a dollar limit. Traders generally set up 1% of the value of the account per trade.

- Pip Risk: Determine the pip risk-on trade. You can adjust your pip risk according to market conditions or have a regular pip stop, such as ten forex pips. While selecting an entry point, you should learn to mark your stop-loss location. It depends on strategy and volatility. Pip is the acronym for “percentage in point” and refers to very small price movements in the exchange rate.

- Pip Value Changes: The pip value changes for each currency pair. Have a proper position size. You can use MetaTrader (MT4) to trade. Most currency pairs have a price quoted to four decimal places and the smallest change in the last decimal place is the pip.

- Position Size: Determine the currency pair you are trading, the stop loss in pips, the account balance, the risk percent of your account, and the conversion currency pair rates.

- Choose an Ideal Position Size: Choose the correct number of units to buy or sell on a currency pair.

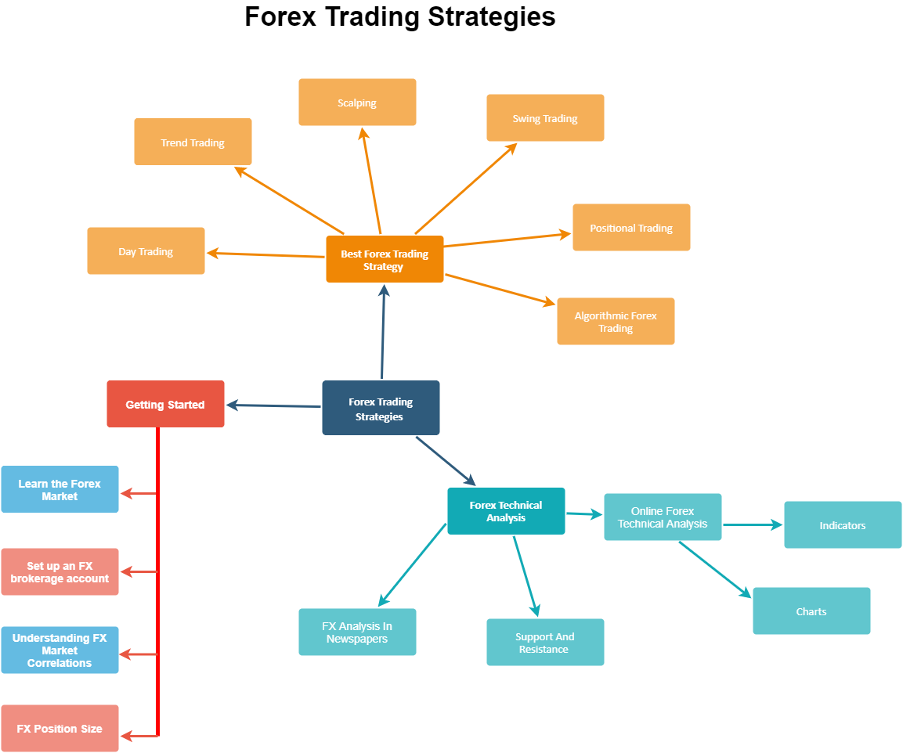

Sourcing Good FX Technical Analysis

Forex technical analysis aims to identify patterns in charts and find the right price level and time to enter and exit the market. Popular charts in trading are the bar chart, candlestick chart, and line chart.

Online Forex Technical Analysis

Technical analysis helps to determine the when and where of entering the forex market. Successful trading involves proper risk management as price change are unpredictable. Choose the best forex trading plan to maximize returns. Forex options trading contracts implement leverage to help traders to benefit from small fluctuations. Traders prefer making informed decisions on the forex currency exchanges after a thorough technical analysis on the currency pairs chosen for trade.

Charts: You can understand the overall forex trendline using charts for the long term and short term. The trend may be upward or downward or range-bound. Traders prefer the usage of candlestick charts, line charts, and bar charts as forex indicators.

A pin bar candle is a single price bar that provides different entries for traders. To trade a pin bar forex, you have to identify a pin bar and open a trade. Trading in the same direction of the pin bar forex is profitable. The pin bar formation shows a price action reversal pattern. Analyze a pin bar candle to trade the market and get a good entry point that yields rewards.

Indicators: You have to identify the support and resistance levels to understand the future trend of the market. A simple scalper makes use of price-action indicators and volume forex indicators.

- The exponential moving average (EMA) determines the entry and exit points of trading. EMA, used along with other trading tools such as RSI, MACD, etc., is the best indicator in stock scalping strategy.

- Price action indicators determine the entry signal and understand the trend. The entry, exit, and stop criteria calculation help in the study of the price action indicators.

- The volume forex indicator measures how much the given currency pair has traded in a period of time. The volume forex indicator also helps to study the advance and decline in specific currency pairs by a simple scalper.

- There are different forex indicators mt4 available to analyze past prices and understand future movement. Moving Average Convergence/Divergence (MACD), stochastic oscillator, and bulls/bears power are three popular forex indicators mt4 preferred by traders.

- Vwap indicator mt4 is almost similar to the moving averages. The Vwap indicator mt4 also studies the average truce price of major currencies.

FX Analysis In Newspapers

Trading news forex has a high impact on intraday trading. Information distributed among forex investors affects the markets. Institutional traders are alert about recent news and analyze them.

Both beginners and experts require forex news to help them trade effectively in the foreign currency exchange. By applying the price action forex, you can enter and exit your trading strategy at the right point. Day trading and swing trading in the currency market, based on trending news, will provide you with profits at regular intervals. For those who require fundamental and technical analysis updates, you can refer to the economic calendar on the Daily Forex. To know the basic steps in forex trading, you have to learn through fundamental and technical analysis.

With price action forex, you can enter and exit a trade at the right point. Day trading and swing trading in the currency market, based on trending news, will provide you with profits at regular intervals.

- Political news plays a vital role in forex markets.

- Central bank policies a crucial role in currency movement.

- Macroeconomic statistics like inflation, employment rate, etc., affect forex moves.

- Balance of trade between countries such as trade deficit and surplus affect market movement.

- The bond market influences the forex exchange rates, especially government bonds.

- Sometimes fake news is generated to manipulate trading.

Selecting the Best Forex Trading Strategy for You

There is no definite answer for the best forex trading strategy. Strategies that work for one trader may not work for another. Strategies that may not work for others may work brilliantly for you. Make use of forex indicators while trading. Forex news includes technical analysis and charting software. Traders can refer to forex trading guides to get acquainted with forex trading strategies and technical analysis. There are many online websites that provide forex news on which traders share effective trading methods. It is of immense help to supplement the trading knowledge that investors already have.

1. Day Trading: Trading From a Few Hours Up to a Day

Follow the day trading strategy by studying the market movement. Profit from the intraday forex market price movements. Forex day trading involves multiple trades per day. In day trading, forex scalping involves a brief holding time for buying and selling currency pairs.

- Application: If you are a beginner to the forex market, day trading is the best forex trading strategy to follow. Your trade will last for a single day during trading hours. You will not face the risk of overnight news or the risk of a sizable market correction. In forex day trading, you can make profits from small price movements. In the stock price action forex strategy, you can study the actual price movements and make subjective decision on your trade. The head and should reversal trade is most popular under price action trading.

Choose a particular forex currency pair. Go long or short and use 50 pips a day forex strategy to realize a profit. You can place orders on either side of the market so that one order gets triggered by the market open and subsequent movements. The other order gets cancelled. As the market continues, you can realize profits. Once achieved, you can close your trade and take-home profits.

To mitigate risk, you can place a stop loss at around 5 to 10 pips above the initial level. You can change it according to the market movement. The 50 pips a day forex strategy is considered a day trading strategy.

2. Trend Trading: Trading through Technical Indicators

Trend trading helps to identify the direction of the market movement. Markets are predictable, and through trend trading, you can forecast what could happen in the future. It can be long-term trading or short-term trading. A trend may be an uptrend, downtrend, or a sideways trend. Identify the trend early so that you can exit the market before it reverses. Forex charts are an integral part of trend trading.

- Application: You can adopt a position trading for the entire period of the trend. You can adopt swing trading and profit from price swings. It is usually medium-term trading. You can use technical indicators such as moving average in forex, RSI, or Average directional index to identify the trend. With a scalping trading strategy, you earn small profits, which would eventually lead to big profits.

3. Scalping: Trades Made in a Minute or Hours

Forex scalping strategy is trading for a very brief duration or with a 1-minute scalping strategy. An fx scalper should follow disciplined trading. The best indicator for scalping is the SMA indicator, the EMA indicator, and the MACD indicator. Keeping a stop loss is highly advisable in scalping forex trading strategy. An fx scalper can execute a trade on long and short sides. Learn to study the forex charts and make use of forex indicators. Backtesting forex strategy is based on past data to determine the trend.

Make use of forex indicators. Back testing forex strategy is based on past data to determine the trend.

- Application: You can trade multiple currencies when the base currency has a central bank announcement or news. You can observe forex signals and in-depth charts, Meta Trader 4 or 5 to have the most accurate views on your trade. With scalping forex, you can make small profits regularly through skimming, using a 1-minute scalping strategy.

4. Swing Trading: Overnight Trade that Lasts for a Few Days

A forex swing happens when you consider overnight price changes or changes within a particular number of days under the swing forex strategy. The idea is to hold the trade to realize more profits than is possible under day trade. Swing trading uses overnight data, such as an election result, to be highly effective. An example of this is the election of President Joe Biden voted as US president. The EU referendum outcome is another example of overnight market movement.

- Application: Apply technical analysis and identify support levels, fundamental data, and recent trade while placing a swing trade position. Price action trading along with technical analysis brings profits. Stay updated on the economic news and go through forex materials to predict price moves.

5. Positional Trading: Long Term Trading with Long Holding Time

A positional forex trading strategy involves long-term trade. You can trade a currency that has appreciated or depreciated significantly over a period using a positional trading strategy. Stock price action trading brings in the practice of systematic trading. You can make decisions by a study of historical data through backtesting forex strategy to understand the trend. Daily forex is a website on which you get daily news and updated market news including forex charts.

- Application: The currency of a strong economy appreciates significantly upon release of a country’s data, and you can apply a scalping trading strategy. Acquire insight into the traded currency. Have ample cash flow in your forex trading platform. Be patient because your funds may get tied up for a significant amount of time under the positional trading strategy.

6. Algorithmic Forex Trading: Trading with a Set of Automated Instructions

Algorithmic forex trading is a significant development of forex trading platforms. Under this strategy, forex trading platforms follow a trading strategy programmed into it. Factors like price, volume, and timing determine trade on forex trading platforms. They influence forex algorithmic trading. It involves increased efficiency and reduces the cost of forex algorithmic trading due to its automated nature. You can have a free forex signal to get live buy and sell signals.

- Application: Professional traders who have significant knowledge and insight in forex trading platforms implement this strategy. It requires market knowledge and math application at a high level. Choose the best forex market timing for trade. Some traders prefer to use Expert Advisors (EAs) for forex signals. The EA executes the strategy placed by the trader when specific criteria are met. Forex signals reduce the risk of loss by helping traders enter and exit trade at the right time.

News Trading: Trading on the Breakout of News

- Major currency pairs traded on the forex market are GBP/USD, EUR/USD, USD/JPY, AUD/JPY, NZD/USD, EUR/CHF, and EUR/GBP.

- The dollar forms a base currency for most currency pairs. Hence US economic releases have to be considered for trading.

- The economic data of a country affect the forex market. When trading news forex, you should know which data is released that week. Information on interest rates, economic growth, inflation, retail sales, industrial production, and manufacturing plays a crucial role in currency movement. A forex hedging strategy will help to mitigate loss.

Best Forex Trading Strategy for Beginners

There are a few simple and effective trading techniques, which provide expert guidance for beginners. Choose strategies that you can understand and build up your skill. Such forex strategies are simple and easily understood by beginners, especially by using forex trading free signals to get live market movement. The free forex signal is a free app that helps you know live market movements. It is best to choose reliable free forex signals, as unscrupulous services may trap traders into making wrong decisions. Day trading and swing trading in the currency market give forex traders an edge over others. Follow a forex hedging strategy to prevent unnecessary risks.

- A Fundamental Analysis of a country’s economy is necessary to identify if the currency value is overvalued or undervalued. Key indicators are the GDP, retail sales, inflation, CPI, housing data and purchasing index data, etc. You can get the latest forexnews by referring to the Forex Factory for information on news releases and key indicators of the economy.

- Moving Average in forex: A moving average strategy with a price crossover represents a change in price trend. You can also use two moving averages. Use the best forex timing when you trade.

- Trading Strategies: There are many forex trading strategies, such as a pin bar strategy, an inside bar strategy, or a forex breakout strategy. As a beginner, you can choose a forex price action strategy for short-term trading. Hedging forex helps to protect your position in a forex currency pair when there is an adverse move. Some providers offer free forex signals for a trial period or for an unlimited time. Learn to use the entry and exit free forex signals to learn forex trading basics.

- Forex Trading for Beginners: Beginners must learn the basics of currency pairs. Learning with demo accounts is best as you do not lose real money. Find a reliable service provider who can provide you with tools and guides for forex trade. Forex trading for beginners starts with learning these tools and guides.

Best Forex Trading Strategy For Professional Traders

To trade forex signals, you have to identify a currency pair for trade. Set an entry point and stop-loss order, and exit when you make a profit.

- Trend Trading: Identify the upward or downward trend using various tools such as relative strength indicators, moving averages, directional indices, volume measurements, etc.

- Momentum Trading: Price momentum in a direction indicates price trends to move in the same direction of trade. When momentum weakens, it shows that the trend loses strength and may reverse. Candlestick charts and oscillators help in the price and volume analysis.

- Range Trading: Currency prices tend to move between predictable ranges within a given time. Stable and predictable currencies move within a range. Choose forex tools such as RSI, commodity channel index, and stochastics, as you learn forex trading.

- Retracement trading: Retracement trading makes use of the trend line and the Fibonacci tool. It is a short-term forex strategy, and the daily chart is studied.

- You can use the daily chart, where the bullish and bearish bars are studied. Choose bars that are colored, as they are easy to identify. Select the Fibonacci retracement tool available in the charts tool. A scalp trader can use traditional chart formations such as triangles or cups and handles for trade.

- Using the Fibonacci retracement tools, plot the trend line. Measure the high and low points of the line and mark the 50% retracement level. Other Fibonacci retracement levels to watch are 61.8%, 38.2%, and 23.6%

- Identify the retracement levels and position yourself for an opportunity to enter a trade.

- Grid Trading

Grid trading is a technique of the foreign exchange market. Here you buy and sell currency pairs at predetermine-price intervals to reap profits. They operate best in a volatile market, where currency pairs fluctuate with big moves.

- Place orders above and below a set price.

- It automatically executes low buy order with a corresponding high sell order.

- It guarantees profits when the selling price moves above the buy order during a sideways price movement.

What is the Best FX Trading Strategy For You?

To start trading in the forex market, you have to follow certain elements:

- Time Frame: Understand the time frame of trade. It may be an intra-day trade, or short duration, such as two days or a week, or a long time frame such as six months, one year or five years, or ten years durations. You can also choose multiple time frames for your trading activity. Forex scalping strategy involves short-term trade to profit out of narrow price movements.

- Trading Techniques: Acquaint yourself with various forex trading techniques such as candlestick chart trading, indicators, oscillators, Fibonacci retracement, etc. Forex price action strategy is the base for your technical analysis of a currency pair. Investors can refer to forums on which traders share knowledge on novel and effective trading techniques in the forex currency exchange.

- Follow the Trend: Follow the forex trendline as a new entrant to the forex market. Once you learn to analyze well, you can take your own decision, or go with the trend or take a contrarian view. Refer to forex trading guides for a better understanding of the market trends. It will help you select the best forex currency pairs that suit your forex trading outlook.

What is the best FX trading strategy for beginners?

- Use Surplus fund: Set aside funds on which you are willing to take a risk. You may or may not make profits. As a new entrant, you can use forex trading free signals for updates about live market changes to stay profitable.

- Trade Small: New investors have to trade small. Choose selective stock, or trade-in fractional shares, which involve fewer funds. With a scalping strategy, you can earn profits. Every trader in the forex market should watch out for the risks associated with the forex currency exchange. Even with low investments, forexnews will provide valuable information for both expert and beginner traders alike.

- Avoid: Avoid trading in small stocks that may become de-listed. Avoid trading during the first half-hour and last half hour of trade as they have high price volatility.

- Timing: Decide when to enter and exit the forex market. Learning forex trading helps to understand how forex trading works, and choose the most active trading times for starters.

- Stay Updated: You should stay updated on political events, forex market news, central government news, economic data, and other market-moving news. Beginners can refer to websites like Daily Forex that provide access to forex information for successful trading. Remain updated on forex news to receive market information to make the best decision.

- Free Signal Forex Telegram: Trading signals send suggestions via the app with many free signal forex telegrams such as Wall Street Forex Signals, Forex Pips Factory, etc.

- Learning Forex Trading: For effective trading, beginners should understand the forex market and trading methods beforehand. You can manage your risk and be successful on your forex trade by learning forex trading. Learn when to start and close trade and get out of the forex market. It will prevent you from falling into a debt trap when the market turns against the direction of your trade.

Summary

If you are a beginner and newly introduced to forex trading, you may want to supplement your household income. Choose the right strategy according to your requirement. Learning forex trading through a demo account will give you experience in the foreign currency exchange. You can then trade small so that your risk exposure is low. You can also refer to forex trading guides to gain more knowledge and to give an entirely new angle to profitable trading.

If you are a hobby forex trader, take a holistic view of trade, such as trading hours. Have clear objectives. Be disciplined, take your time, and experiment with different strategies in the forex trading system. Choose the one that suits you and rewards you. However, experiment with funds that will not impact you financially and are willing to lose. Forex trading strategies enable people person to become successful traders by providing expert advice for beginners. Forex trading for beginners may look overwhelming, but take it step-by-step and you can learn to trade with ease.

While learning forex trading, you should also learn about the currencies you trade. New traders should not start to trade on everything that moves. Pick a few currencies in the forex currency exchange. Forex trading for beginners begins with learning about currency pairs and understanding new strategies for profitable forex trading. Even the best trader is not 100% profitable. Pick strategies that suit your risk attitude in the foreign currency exchange.

Discipline your trade and budget, select the correct strategy and begin with a demo account. Test your forex strategies and theories. A survey reveals that 84% of retail investors lose money in the initial stages of their trading careers. So be prepared, make good use of trading instruments. Happy Forex trading!