The foreign exchange market is also known as the forex market or FX. It is an over-the-counter marketplace where you can exchange currencies of different countries across the globe. The foreign exchange is the world’s most liquid asset market. Currencies of various countries trade in pairs. It determines the currency exchange rate of all currencies. Transactions occur 24 hours a day, five days a week. On the foreign exchange market, traders can exchange one currency for another currency.

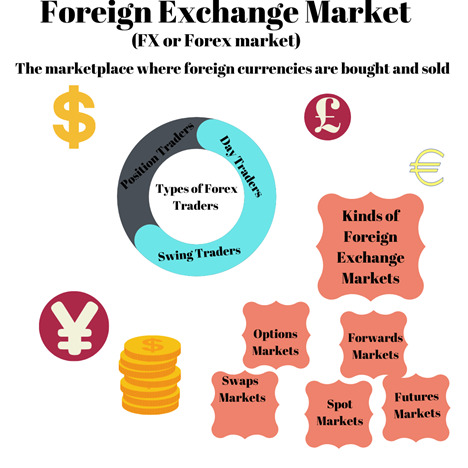

There are different kinds of foreign exchange markets used for currency trading. They are the spot market, forward market, future market, future market, and options market.

You can trade as a scalper, day trader, or swing trader. You can also be a position trader or an algorithmic trader. Position trading, swing trading, and day trading are the most used types of trading.

What Is The Foreign Exchange Market?

The foreign exchange market is a marketplace on which international currencies trade in pairs. It determines the exchange rate of different currencies, which helps in currency conversion in the foreign exchange market.

It is a marketplace for the exchange of national currencies across the world. Foreign exchange trading is the most traded market in the world.

Need for the Foreign Exchange Market

- Currency conversion is one of the most important functions of the foreign exchange market.

- It determines the value of each currency, which makes it easier to exchange currencies against one another.

- It promotes international trade.

- The forex helps importers with short-term credit, which enables the flow of goods and services across countries.

- Traders can hedge their foreign exchange risks through the Forward Contract or Futures Contract.

How It Works

Investors in the foreign exchange market take positions on the currency pair of their choice. Currency futures have high liquidity and are less volatile. When traders expect the currency prices to appreciate against another currency, they buy futures contracts.

- The marketplace works on the demand and supply of currencies which determines the currency rates.

- Foreign currency rates keep fluctuating.

- The foreign exchange market determines the value of the currency of global countries, making it easier to exchange currencies between any two countries.

- Currencies trade in pairs on the foreign exchange market.

- Investors and traders should consider forex as a long-term investment trading activity. Traders can gain experience with a forex demo account and take a realistic view of the market. Learning forex trading is a continuous process.

- You can trade on the spot market and the derivatives market. They provide opportunities to trade on forwards, options, futures, and currency swaps. Speculation is possible through hedging on the global currencies. Learning forex trading makes it very rewarding for newbies in the forex market.

The forex market is an exciting journey in the financial world, especially for beginners. There are many players in the forex markets. As a beginner, you should educate yourself on the foreign exchange market. Decide what kind of trading you want to execute on the forex market and build your trading strategy according to your preference. Be committed to your trading, and develop the skills and trading strategies to be profitable in the forex market over the long term.

Key FX Markets

Major forex markets are in London, New York, Tokyo, and Sydney. Major currency pairs traded frequently are the GBP/USD, EUR/USD, and USD/JPY.

Most Traded Currency Pairs

Each country has its own official currency. But, active trading takes place in a few currency pairs. The American dollar is the most traded currency due to the economic strength of the United States. Forex currencies usually trade in pairs.

Common currency pairs traded in the forex market on the US Dollar are:

- USD/JPY

- USD/GBP

- USD/CAD

- USD/CHF

- AUD/USD

- NZD/USD

Cross-currency pairs are currency pairs that do not trade against the US Dollar. Commonly quoted forex currencies in the forex markets are:

- EUR/GBP

- EUR/JPY

- EUR/CHF

- EUR/AUD

- EUR/CAD

- AUD/CAD

- AUD/NZD

- GBP/CHF

- GBP/JPY

- CHF/JPY

FX Market Opening Times

The forex markets operate 24 hours a day across every country. As the time zones vary for different countries, the forex market trades over 24 hours.

The forex market works from 5 pm EST Sunday until 4 pm EST on Friday. The FX markets remain closed on weekends.

The best time to trade forex is when the New York and London Exchanges timing overlap, between 8 am and noon.

Currency Market Size and Volume

The currency market is the world’s largest financial market. The daily volume traded on the forex market is $6.6 trillion.

According to reports from the Bank for International Settlements, the volume traded on the forex markets is higher than that traded on the stock markets,

The forex market is the most traded market, with a $1.93 quadrillion in 2021.

The most traded currency pairs by volume are the USD/CAD, EUR/JPY, AUD/USD, and USD/JPY. The US Dollar (US$) is the most liquid-traded currency, after which the Euro (€), the Japanese Yen (¥), and the Pound Sterling (£) follow.

History of the Foreign Exchange Market

Before the foreign exchange market came into existence, currencies were pegged against precious metals like gold and silver.

By the Bretton Woods Agreement, the US Dollar replaced gold for the purpose of international currency transactions.

The current foreign exchange market formed in the 1970s determines the demand and supply factors prevailing in the international market. Currency exchanges allow you to swap one currency for another.

The Financial Conduct Authority (FCA) regulates the forex market in the United Kingdom. In the United States, the National Futures Association (NFA) and the Commodities Futures Trade Commission (CFTC) are the two agencies that regulate forex trading.

Foreign Exchange Market News

Choose the best time to trade forex. In New York, the best time for trading on the forex market is just after the open of the session, which is at 8 am. It is the same in London where it is best to trade at 8 am when the session starts.

To know about forex industry news, professional traders prefer to connect to forex factory news. Live forex charts are easy to use. They track the movement of the currency pairs across the globe. Live forex charts are interactive and provide various technical indicators used for forex trading.

The forex market hours are available 24 hours a day but are closed on weekends. Choose forex market hours that suit your strategy best. It is due to the different time zones of countries across the globe.

Currency pairs are quoted in pips (percentage in points). Pip forex is a hundredth of one percent, located on the fourth decimal place. Traders find that even a minimum change in pip forex value brings a significant difference in the net profit or loss.

Biggest Operators In The Foreign Exchange Market

The foreign exchange market has big operators, like banks, hedge funds, investors, and retail foreign exchanges.

The forex is a great way to invest money. The forex market provides massive opportunities and profit for those involved in forex investing.

Big traders make use of the forex trading signals to analyze whether it is the right time to buy or sell a currency pair. Forex signals are available for free and also for a fee.

Banks

Financial institutions like central banks, commercial banks, and money managers are the major players in the forex markets. The central banks ensure that the currency rate fluctuates within the desired limit. They control the money supply in the market. Commercial banks provide foreign investments and facilitate international trade.

Hedge Funds

Hedge funds use pooled funds to generate high returns. They use various forex strategies to earn returns from their investors. They go long when they foresee a rise in the market or go short when they anticipate a fall. According to reports, more than 3,635 hedge funds are functioning in the US.

Hedging safeguards the position of an fx trader in the forex exchange. Hedge fund managers are financial companies with professional analysts and portfolio managers. They usually trade on the forwards and futures markets.

Leverage in forex is using borrowed funds to multiply trading positions. Big traders like hedge funds make use of leverage in the forex market. They borrow funds to raise their trading position and can enjoy profits through margin trading. It is a part of CFD trading and makes use of small price movements to book profits.

The forex hours for day trading can be hours or minutes. It works on incremental gains on a single day.

Investors

Investors form a very small portion of the entire forex volume. Investors can day trade and speculate on the most traded currency pairs like the GBP/USD. They buy, sell, speculate and exchange on the currencies. Investors prefer forex day trading for short-term returns on an intraday basis.

Hugo forex is an unregulated forex broker offering 56 currency pairs and 16 cryptocurrencies through the MetaTrader 4 trading platform.

Trading forex for dummies is for those who are new to the forex market. They learn the fundamentals of the currencies traded. Investors must learn basic concepts such as currency rates, price movements, incoming news, and data, such as interest-rate expectations, inflation, economic growth, etc.

Retail Foreign Exchange

With access to the Internet, retail fx traders in the foreign exchange can connect to the forex market. Retail traders and investors have become a major part of the forex markets and trade through computer networks and trading terminals.

Forex day trading is popular among retail traders. Traders analyze the market, monitor the trading charts, and use the short-term day trading strategy for quick returns. It is best to follow the latest forex news and trading strategies to keep up with the trend in the forex market.

Scalping forex refers to skimming small profits by holding position on the currency pair for a very short time. Traders gain low profits by scalping forex. Trades are placed many times throughout the day. They do not require in-depth analysis to execute repeated trades. Tick charts and one-or two-minute charts are sufficient for scalping forex.

Trades work on real-time data providing forex live quotes. Live streaming of forex rates, daily changes, and updated rates make trading easier for traders. With forex live rates, investors and traders make trading decisions.

The US30 forex is also known as the Dow Jones 30 or DJ30. It measures the performance of thirty publicly owned companies on the NY Stock Exchange.

US30 forex is one of the most used indices, influenced by risk sentiment across the globe.

FX Market Makers Explained

Forex factory news provides the fastest breaking news in the foreign exchange market.

Forex trading signals are a set of analyses for a forex trader. They generate signals to give a buy or sell call on a currency pair. They are available on your email or smartphone. You can get free forex signals by opening a MetaTrader trading account. You can also open an MQL5 account for free forex signals.

FX Trading – A Brief Explanation

Forex market trading takes place on spot markets, futures markets, and forwards markets.

Forex trading has a long trade and a short trade.

There are various types of trading practices. They are scalp trade, day trade, swing trade, and position trade.

The foreign exchange market has high liquidity and provides market transparency, and operates 24 hours a day. Forex trading profits are rewarding if you use a good strategy and use a risk management scheme.

You have to keep up with the forex news and key reports and events to remain in tune with the forex movement.

Forex trading strategies used on the forex markets require technical analysis usage, such as moving averages, breakout, charts, etc. It is a short-term strategy that yields quick returns.

- Market participants exchange currencies against one another.

- Speculation in the currency market depends on geopolitical events.

- To diversify the currency portfolio.

Robinhood forex does not allow forex or futures trading.

A spread in forex is the difference in the sell rate and buy rate of the forex broker. A high spread in forex indicates a huge difference between the asking price and the bid. It is best to trade when spreads are lower.

Institutional Investors

Institutional investors dominate trading activities in the forex markets. Speculative trading transactions are profit-motivated. Pension funds, insurance companies, mutual funds, and exchange-traded funds (ETFs) play an important role in institutional investors. Institutional traders and investors buy and sell securities for a group or institution for accounts they manage. They participate in forwards and swaps.

High-frequency forex is the usage of algorithms to help traders make a trade. They use a complex set of indicators and market data through automated trading assistance. High-frequency forex used by large institutions and big players in the market causes volatile market movements in the forex markets.

Individual investors

Individual investors are different from institutional investors as they trade, buy or sell securities on their personal accounts. They make individual decisions on their trade, with minimum quantity.

Safety is the first thing to consider in the forex for beginners. Other factors are safety, low fees, educational tools, customer services, low deposit, and an easy process to open an account.

The minimum amount you need to trade on the forex market is around $100. However, it is best to learn more about the forex market before you start trading in it. You can converse with others in the community about forex trading strategies and ideas on the forex trading Reddit. There are many active users on the forex trading Reddit. They update trading ideas and trading psychology on it.

The best US forex brokers are Forex.com, TD Ameritrade forex, IG forex, and Interactive brokers. They are regulated and licensed by the National Futures Association (NFA). TD Ameritrade forex platform provides trade alerts and real-time scanning and is one of the best US forex brokers.

How Forex Platforms Service this market

Traders access the forex market through the best forex trading platform. On fx trading platforms, traders gain access to all asset classes. It acts as a venue to buy, sell, exchange, and speculate on currencies. It allows currency conversion in the foreign exchange market for international trade and investment purposes.

Deliverable Foreign Exchange Market

The deliverable foreign exchange market offers a same-day payment facility.

Two parties can exchange and settle the notional amount of two different countries on the same date. It includes spot transactions, forward transactions, and swaps transactions.

High-net-worth individuals and institutions prefer hfx forex as it provides diverse strategies for forex trading under all market conditions. Hfx forex helps investors gain from small price movements.

Before trading on the derivatives, choose forex trading platforms like eSignal, as they are best for professional traders with superior charting tools.

Business Money Transfers

Money transfer for businesses of every size and shape is possible through the foreign exchange market. Business gets exposure to the forex market. Transfer of money is possible with low margins and low fees. It is a secure way to transfer money overseas.

Private Client International Payments

Private clients make international payments as a single transaction or as recurring payments across the globe. They can receive and send foreign currencies without converting them into the home currency. They are used to fund the child’s tuition or to pay for the international mortgage payment.

Retail and Travel money FX market

The foreign exchange market is the largest and most liquid market. Globalization has brought in international transport. Travel and tourism to other nations are increasing, for which you need the best exchange rate for the currency you require. You can also use forex travel cards to pay for your expenses in the local currencies abroad. You get many benefits to pay for your travel expense with low exchange rates.

Bureaux De Changes

A bureau de change is a currency exchange. It has the license to assist customers in exchanging foreign currencies. It makes a profit by buying foreign currency and selling it for a profit.

Online Travel Money Providers

Forex Travel money providers are authorized and reliable forex service providers of foreign currencies. They provide regular status updates and live tracking to streamline your forex transaction. Users gain access to rate alerts so that they can block the rates to avoid rate fluctuations. There are 24 forex trading hours, as the forex market is active across the globe. It works in different time zones across countries.

Prepaid Currency Cards

Forex prepaid cards make it easier to make payments in several foreign currencies. They are a secure and convenient alternative to carrying foreign currencies while traveling overseas. It is used to book international flights and for accommodation purposes.

It is not easy to understand forex for beginners. We recommend researching the basics in the forex markets and choosing the best forex brokers.

Summary of the Foreign Exchange Market

The forex market is one of the most liquid markets in the world. They are regulated markets and work according to the jurisdiction of their location.

The foreign exchange market determines the exchange rate for global currencies. Participants can buy, sell, speculate or exchange on the currency pairs. Foreign currency rates fluctuate and keep changing at any given moment. The foreign exchange market determines the value for each foreign currency so that the exchange of different currencies is made easier.

Market forces determine the rate of any foreign currency. Tourism and demand for currency exchange are other factors that determine the rates of the currency exchange.

Choose some of the best forex trading platforms, such as Plus500, which is the best forex trading for beginners. The best forex brokers are XTB, Vantage FX, and AvaTrade that have trading apps and are affordable. Beginners make use of the copy trading facility on the eToro. The IG forex comes with ProRealTime and requires a $0 minimum deposit, though listed on the FTSE 250.

Forex trading for beginners starts with learning the basics of the currency pairs, learning with forex demo accounts, and finding a reliable service provider.

The need for a foreign exchange market is high. Investors prefer to invest in the foreign exchange market, while traders and speculators prefer to profit from the price fluctuations in the foreign currencies. An average retail trader will not find it easy to make money from forex trading. It is a rocky path that may lead to enormous losses. It requires experience and in-depth analysis. Make sure that you invest spare money in the foreign exchange market for trading purposes.

The foreign exchange market has become a prime necessity with an increase in global trading and international investment. The foreign exchange market has become necessary to ensure the smooth functioning of day-to-day transactions across different countries, without which trade and commerce will not be possible.