Foreign Exchange Trading Sentiment

FX sentiment tools are the exchange rates heat map. They predict the future trend using sentiment tools to alert traders on forex conditions. They are used along with fundamental and technical analysis to make currency exchange rates forecast.

Forex currencies are volatile and require expert advice from analysts and financial institutions to make foreign currency exchange rate forecasts.

Exchange Rate Forecast Explained

Exchange rate forecasts made by banks and FX analysts cover various foreign currencies. Many financial news agencies collect current exchange rate forecasts from sources like Reuters, Bloomberg, and CNBC. They provide periodic FX reports.

Market sentiment refers to the attitude that investors take in the forex market. Investor interest is visible in the price movement of that particular security in the forex.

- A bullish market sentiment happens when prices rise.

- Bearish sentiment is when prices are falling.

Learning forex trading will help you understand forex terms and the tools involved in forex trading. You can refer to forex trading guides to understand forex trading strategies better. Forex news provides real-time alerts on what is happening in the economy. Traders prefer to choose currency pairs by referring to the daily forex and forex signals to gain profits. The daily forex is an excellent platform when it comes to forex trading.

| Currency Symbol | Current | Q1-20 | Q2-20 | Q3-20 | Q4-20 | Q1-21 | Q2-21 | Q3-21 | Q4-21 |

|---|---|---|---|---|---|---|---|---|---|

| AUD/CAD | 0.96 | 0.98 | 0.97 | 0.95 | 0.95 | 1 | 1.03 | 1.05 | 1.06 |

| AUD/USD | 0.73 | 0.8 | 0.76 | 0.74 | 0.73 | 0.74 | 0.75 | 0.78 | 0.8 |

| EUR/CAD | 1.5 | 1.55 | 1.52 | 1.5 | 1.49 | 1.52 | 1.55 | 1.58 | 1.6 |

| EUR/GBP | 0.88 | 0.89 | 0.88 | 0.89 | 0.88 | 0.89 | 0.89 | 0.88 | 0.87 |

| EUR/USD | 1.13 | 1.23 | 1.16 | 1.15 | 1.12 | 1.13 | 1.14 | 1.15 | 1.16 |

| GBP/CAD | 1.69 | 1.75 | 1.73 | 1.68 | 1.69 | 1.72 | 1.74 | 1.76 | 1.8 |

| GBP/USD | 1.28 | 1.41 | 1.35 | 1.27 | 1.31 | 1.33 | 1.35 | 1.37 | 1.39 |

| NZD/USD | 0.68 | 0.72 | 0.7 | 0.66 | 0.68 | 0.7 | 0.73 | 0.75 | 0.75 |

| USD/BRL | 3.74 | 3.29 | 3.55 | 3.86 | 3.75 | 3.9 | 3.8 | 3.65 | 3.6 |

| USD/CAD | 1.31 | 1.23 | 1.29 | 1.3 | 1.31 | 1.31 | 1.29 | 1.3 | 1.31 |

| USD/CHF | 0.99 | 0.96 | 0.99 | 0.98 | 1 | 0.98 | 0.96 | 0.94 | 0.94 |

| USD/INR | 71.77 | 64.36 | 67.73 | 70.01 | 72.89 | 67.5 | 67.3 | 67 | 66.8 |

| USD/JPY | 112.81 | 108.54 | 109.31 | 110.57 | 113.91 | 111 | 108 | 106 | 104 |

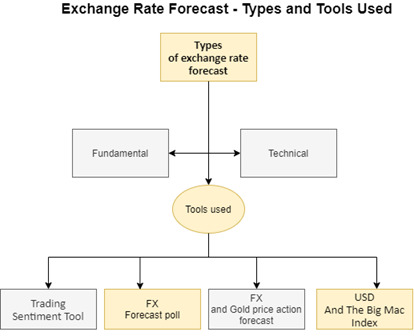

Types Of Exchange Rate Forecast

Global companies with business activities in foreign countries follow these FX rate forecasts to identify medium-term exchange foreign currency risk management strategies to exchange foreign currency. They are used along with trading sentiment tools.

Traders analyze the market sentiment using fundamental and technical indicators to forecast currency exchange rates. Learning forex trading becomes easier with an understanding of forex indicators.

- Fundamental FX Forecasts: Fundamental forecasts prescribe the underlying exchange rate between two currencies. They undergo depreciation and appreciation against other currencies. Investors prefer safe-haven exchange currencies like the US dollar when the economy is not doing well. The true value of a currency is revealed during times of war and uncertainty, such as the Russian war on Ukraine.

Attributing factors that influence currency exchange rate forecast are:

- Interest rates

- Employment

- Inflation

- Geopolitical news.

2.Technical FX Forecasts: The forecast uses historical currency change in the exchange rate trends. They use predictive charts modelling past behavioural patterns for this purpose.

Critical factors used in the technical fx forecasts by analysts are

- Economic

- Political

- Social

These factors help to predict foreign currency exchange rates. Technical analysis of these factors helps to calculate reliable predictions.

Day and swing traders rely on market sentiment to measure profits in the short term. Some investors prefer to take a contrarian view to forecast currency exchange rates.

What Affects Exchange Rate Forecasts?

- Interest Rates

Interest rates and inflation have a high correlation to forex rates. They affect the dollar exchange rate. An increase in interest rates will appreciate the currency value.

The interest rates set by the ECB determine the euro currency to USD, while that set by the Bank of England determines the GBP/USD. The Fed policy statement plays a significant role in all currency pairs.

- Inflation

Inflation increases when prices soar higher. A low inflation rate brings a rise in forex rates and vice versa. A high inflation rate brings in a high interest rate and depreciation in currency value.

High inflation in the UK and the EU has hit the GBP/USD and the Euro currency to the USD.

- Deficits and surpluses

A deficit or surplus in the current account of a country reflects the balance of trade and earnings. A current account deficit indicates higher imports, while a surplus indicates higher exports.

The export of metals, iron ore, and coal affects the Aussie dollar to the US dollar. The US dollar to CAD, called the Loonie, is closely linked to oil prices, as oil is its main export.

- Public Debt

The national or public debt is the debt of the central government. If the government debt climbs higher, foreign investors prefer to shed their bonds in the open market. It decreases the exchange rate value.

The financial crisis and political tension in Turkey have driven the TRY lower as public debts have accumulated.

- Speculation

When there is a rise in currency change, the demand for that currency increases. It brings an increase in the exchange rate as well. Speculation on the US presidential election led to wide speculation on the greenback.

The US dollars to pounds and the USD to euro exchange rate were highly volatile during the Presidential election in 2020.

Important events and news affects the currency pair price movement. Learn forex trading and analyze economic, social, and political events to take the right forex decision. Forex charts and free forex signals help in forex trading for beginners.

Forex Forecasting Tools Explained

Investors use forecasting tools to predict currency changes. An analysis is made on pound to euro today and USD to euro exchange rate and other most-traded currencies for profit-making.

1. Trading Sentiment Tool

An analysis of the position of traders will influence the trading decision in a foreign exchange market. Sentiment indicators can be a numeric or graphic representation.

- The IG Client Sentiment is a trading strategy tool. It reveals the long and short trades in a particular forex market, such as the US dollars to pounds and the exchange rate euro to USD.

- The Commitment of Traders Report (COT) is another sentiment tool for forex traders. It is a weekly publication by the Commodity Future Trading Commission that gives a strong market signal.

Currencies like the euros to US dollars and pound to euro today have a high daily trading volume that attracts investor attention.

- Future Open Interest statistics help gauge sentiment by looking at the open interest data available on the futures exchange.

The volume and open interest are affected by the change in prices. It signifies that the price trend will change or continue. When the metrics like the euro converter decline with the rise or fall in prices, it portrays a changing trend.

If the euros to US dollars are trending high, the open interest in the euro futures provides additional help to investors on the currency pair. A declining open interest is a signal that the uptrend will reverse in the euro converter.

- Currency volatility carries a high degree of risk but has a potential for higher profits. High volatile currency pairs make big moves.

- The Relative Strength Index (RSI) indicates the entry point into the market for traders. It shows the recent gains and losses to predict the strength of the price trend. The RSI is a momentum indicator that indicates an overbought or oversold condition. Any reading below 30 signifies an oversold condition, while it reflects an overbought condition above 70.

Why Use A Trading Sentiment Tool?

The sentiment tool is used with fundamental and technical analysis, as it helps investors understand the trend. Forex trading for beginners starts with learning to use fundamental and technical analysis, along with the sentimental tool.

- The trading sentiment tools help to take a contrarian strategy across forex markets. Investors can determine the future price action.

- When investors are very bullish on the currency pair, it is a contrarian signal that market prices could head lower. You can understand the optimistic or pessimistic mood of the people when they exchange foreign currency.

- When sentiment readings are extreme, it signals that a reversal will take place.

- The Brexit deal affected the pound to the US dollar in November and December 2020. But the British pound to USD has been steadily climbing, with a contrarian view as many investors took a bearish attitude.

- Rising sentiment indicates that few bulls are left in the forex market to keep the trend up, and a price reversal is due. When prices move lower, it is time for sentiment traders to remain short.

- Traders can identify entry and exit points for trading on the forex currency exchange. The trader can watch out for price reversal to take the right decision at the right time.

- Free forex signals that traders frequently use are moving average, Bollinger Bands, Fibonacci retracement levels, etc. The support and resistance levels are identified, to decide on the entry and exit points for a trade.

2. FX Forecast poll

A forex forecast poll is a tool that predicts the near and medium-term mood to calculate the trend. The weekly survey provides a five-year history in major currency pairs. It comes as a weekly, monthly, or quarterly survey.

An fx forecast poll is a sentimental tool used in short-term trading strategies. It is easy to understand as traders can view it as a graphic representation. Day traders who trade for a single day can choose the time horizon for the day. Swing traders can choose a weekly, monthly, or quarterly time horizon to make a money exchange forecast.

Learn forex trading strategies to know about forex signals and forex pips. Refer to forex news to understand how real-time price movement in currency pairs affects the forex market.

The dollar versus the euro is one of the most traded exchange foreign currency pairs. The currencies of both countries are reserve currencies.

Why use an FX forecast poll?

- It is used as a heat map to understand the sentiment and predict its movements.

- As the survey is immediately published, it indicates the current trend.

- Traders generally follow the crowd and the forecast poll is useful for contrarian thinking.

- When used along with technical and fundamental analysis, it will provide profitable currency trading.

- While trading short-term, the user keeps a keen watch over forex pips, as they show very small changes in currency price value in the currency exchange calculator.

- The US dollar index fell steeply in March 2020, during the coronavirus pandemic. But it recovered immediately to 103.96 in March, the highest since January 2017.

- Though the recovery was immediate, the US dollar index fell towards 95.70 levels in June 2020. But after the resurgence of the virus in 2021, the DXY moved below 90.00 levels towards 89.70 in January and June 2021.

- The EUR/GBP slumped to 0.0654 during the pandemic in March 2020 but recovered later. The second and third wave which hit the economy pushed the EUR/GBP to 1.1710 levels in March 2021.

- The US dollar to CAD did not panic during the pandemic in March 2020 and remained at 1.2950, but sudden panic put the pair to 1.3960 levels.

The forecast poll works as a sentiment tool. As a trader, you can form unanimity among the experts or divergence among them.

Forex Forecast Poll in Major Currencies

- The US Dollar index fell steeply in March 2020 to 94.70 levels, when the coronavirus pandemic hit the global economies. But it recovered within a week to 103.96 in the same month, the highest since January 2017.

- Though the recovery was immediate, the US Dollar index fell towards 95.70 levels in June 2020. But after the resurgence of the virus in 2021, the DXY moved below 90.00 levels towards 89.70 in January and June 2021.

- The EUR/USD slumped to 1.0654 during the pandemic in March 2020 but recovered later. The second and third waves which hit the economy pushed the EUR/USD to 1.1710 levels in March 2021.

- The US Dollar to CAD did not panic during the pandemic in March 2020 and remained at 1.2950, but sudden panic put the pair at 1.3960 levels.

- Forex pips are small price movements that traders use most in day trading activities.

The forecast poll works as a sentiment tool. As a trader, you can form unanimity among the experts or diverge and take a contrarian view. Users prefer to combine the forex forecast poll tool with their fundamental or technical analysis.

While using the currency rate forecast tools, users should remember that these tools do not represent the final decision on trade. Traders must analyze the sentiment prevailing in the forex market and make their own decision.

Decision-making using the money exchange forecast depends on each individual trader. Traders must not expose their savings to the currency market. Use spare money you are willing to use, as the forex market is volatile. You may lose money while making inaccurate currency rates forecasts.

3. Using FX and Gold price action forecast

The forex and gold price action forecast is another tool to help in profitable trading. Generally speaking, gold moves inversely with the direction of the US dollar. Its current price is the exchange rate per gold ounce.

- Gold reacts to any change in the dollar price and has its own technical rules for the exchange rate. Though gold is a 24-hour market, it trades most during currency trading hours of the US dollar.

- Investor sentiment and many economic factors affect the price of gold inversely with the value of the US dollar.

- The value of the USD depends on factors such as interest rates and inflation rates. The direction of gold rates reflects the strength of an economy.

- Leading stock exchanges, such as the Dow Jones and the NASDAQ, are connected with the gold rate movement.

- Central banks and multinational companies hold most gold reserves. The demand and supply of gold in the market determine its prices. Big investors prefer investing in gold, while small investors prefer to invest in gold as a safe investment.

Gold Analysis in June 2021

Gold has a confluence of various technical analyses at $1766 per ounce in June 2021. The 50% retracement and the 61.8% Fibonacci extension of 2020 are all placed at this critical support level.

The IG Client Sentiment reveals the net-long traders in gold at a +6.12. It is a bearish indication, where 85.9% of traders are long.

Gold Analysis in March 2022

The situation in Ukraine deteriorates as Russia assaults Ukraine. Gold is a safe-haven asset, and investors rush to the safe-haven as the forex and stock market move lower.

The S&P 500 and the NASDAQ extend their fall as attacks intensify in Ukraine. Gold prices soared higher when they crossed the five-month high placed at $1.965 per ounce in March 2022. It hit $2,002 per troy ounce as tension mounts in Ukraine. An overbought condition brought down prices to $1,970, as traders resorted to profit-taking.

- USD And The Big Mac Index

The Big Mack measures purchasing power parity (PPP) among nations. The McDonald Big Mac is a benchmark that has become a global standard for currency prediction. The Big Mac Index is a tool for currency comparison, introduced in the 1980s.

According to the law of one price, the forex rate of one currency measures the rate of one currency against another. The Big Mac sold in McDonald’s restaurant chain is chosen for this purpose. It compares the price of Big Mac in one country with the price in another country in their currencies.

The price of the Big Mac in the US cost $5.66 in January 2021. It costs 3.29 pounds in the United Kingdom. The actual exchange rate was 0.74% at that time. But the implied exchange rate is 0.56%, which indicates a 22% undervaluation in the sterling.

The Big Mac Index plays an important role in purchasing power parity. It is a simple indicator of global currency values. Big Mac costs are lower in countries like Turkey, Russia, and Malaysia, as the Lira, the Rouble, and the Ringgit are some of the most undervalued currencies.

The Big Mac Index is useful for long-term trading. The trader analyses the fundamental value of currencies while using the Big Mac Index.

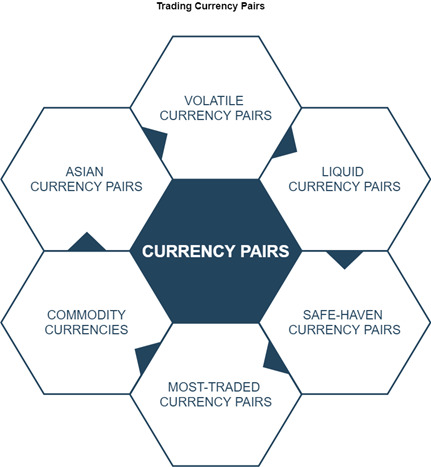

Understanding Currency Pairs

Currencies trade in pairs. They help to understand the strength or the weakness of the accompanying currency with the base currency. The US dollar is a global currency and the benchmark currency in forex markets.

- Forex for beginners is easier, once you acquire basic knowledge of forex currencies. Fundamental and technical knowledge are some basic requirements for a beginner.

- Forex trading strategies and techniques will help you determine whether to buy or sell a particular currency pair. Choose the right time and rate to enter and exit the market. Price action trading, forex day trading, scalping forex, swing trading, and range trading are a few top trading strategies.

- Traders refer to live forex charts to study the volume data and the historical behavior in the price of currency pairs. In the foreign currency exchange, traders refer to forex charts in real-time to understand its price trend.

- Refer to fx news and daily forex to remain updated on the forex market.

- Choose the best forex brokers like IG, Saxo Bank, TD Ameritrade, and Interactive Brokers.

- Choose the forex trading platforms that offer low or no fees for transactions. The best forex trading platforms are AvaTrade, eToro, Plus500, and IG.

- You can trade 24-hours a day on the forex market. But the best time to trade forex is between 8 am and 12 noon when the New York and London Exchanges overlap. Choose trading times when the most action happens.

Volatile Currency Pairs: The most volatile currency pairs are the AUD/USD, AUD/JPY, NZD/USD, AUD/GBP, CAD/JPY currency pair. Apart from the major currency pairs, other emerging market currency pairs are highly volatile such as the USD/TRY, USD/ZAR, and USD/MXN.

The Aussie dollar to US dollar is one of the most volatile pairs in the forex. The au to US dollar has a negative correlation to the US dollar, and it is commodity-driven.

The Brexit deal between the UK and the EU in 2020 kept the euro to dollar conversion, the dollar to euro conversion, and the pound to the euro conversion volatile.

Liquid Currency Pairs: Currency pairs like the British pound to USD, EUR/USD, USD/JPY, and USD/CHF are liquid currency pairs and are not very volatile. The Average True Range (ATR) analyses the volatility of any currency.

Safe-Haven Currency Pairs: Swiss franc, Japanese yen, and the dollar. The best safe-haven currency in 2020 was the US dollar. The US dollar and the Swiss Franc are considered safe-haven currencies. The USD/CHF moves in tandem with each other and is less volatile.

Most Traded Currency Pairs: USD/JPY, EUR/USD, GBP/USD, EUR/GBP, and USD/CHF are the most traded currency pairs that traders prefer to indulge in the forex market.

Commodity Currencies: AUD/USD and USD/CAD are commodity currencies.

Asian Currency Pairs: When two currencies have a positive correlation, they are less volatile.

There is no direct relationship between the US dollar to rupees. Any strength in the US dollar is transmitted to the US dollar to rupees pair, as the USD is the base currency.

After the financial crisis, the Singaporean dollar to USD became one of the best-performing currencies. The Singaporean dollar to USD attracts offshore investors as it is less regulated than the yuan.

The HK dollar to USD is used both in Hong Kong and its neighbour Macau. The HK dollar to USD is one of the most traded currencies, as it is a leading financial global centre.

The dollar to Pakistani rupees relies on open market rates. The State Bank of Pakistan (SBP) sets the inter-bank closing foreign currency exchange rate.

Understand the factors that affect currency exchange rate forecast, use appropriate tools, and enter the market at the right time to make profits from the forex market.

Currency Rate Forecast Models

The forecast currency exchange rates help entrepreneurs make forex decisions to maximize returns.

- Purchasing Power Parity Model

The Purchasing Power Parity or PPP is the most popular method to make currency rates forecast. The PPP theory states that identical goods should have the same price in different countries. The Big Mac Index is an often-quoted example of the PPP theory. It shows if a currency is over-priced or under-priced.

Investors and traders forecast the currency exchange rates to predict price movement. However, users must understand that none of these theories are 100% effective. Every theory has its limitations. Understand the market and make a personal decision. Invest money that you are willing to lose. The foreign currency exchange is subject to volatile movement.

- Relative Economic Strength Model

When economic growth is strong, the forex currency exchange attracts more investors. Investors prefer to choose foreign currencies of countries with strong economic growth. When the investor’s interest in purchasing a particular currency pair increases, the value of the currency pair increases. Any increase in the demand and supply of currency increases its price value. Factors like a hike in interest rates, lower inflation, and good GDP growth increase the value of a currency.

- Econometric Models

Traders analyze the relevant factors associated with a certain currency. These factors are then connected to forecast the exchange rate.

- Time Series Model

Traders analyze the price patterns and the past behavior of a currency pair to predict the future price pattern.

To Summarise

If you are unusually skilled in forex trading, you can reap huge profits from the foreign currency exchange. But if you are an average trader, be prepared for losses. Statistics prove that 68% of investors lose money from trading currencies. The forex currency exchange is not the place for fast profits, as it is a volatile market.

To gain skills you can refer to websites, forexnews, forex trading guides, and daily forex to learn more about forex trading. But experience is the best teacher.