The ECB kept its interest rate level steady at 0% this week despite ambition from investors that the European Central Bank would look to kick start the economy again. Mario Draghi did, however, confess that the ECB would strongly consider rate cuts in future meetings but stated that a negative rate cut hadn’t been considered for this ECB meeting but would be in future discussions.

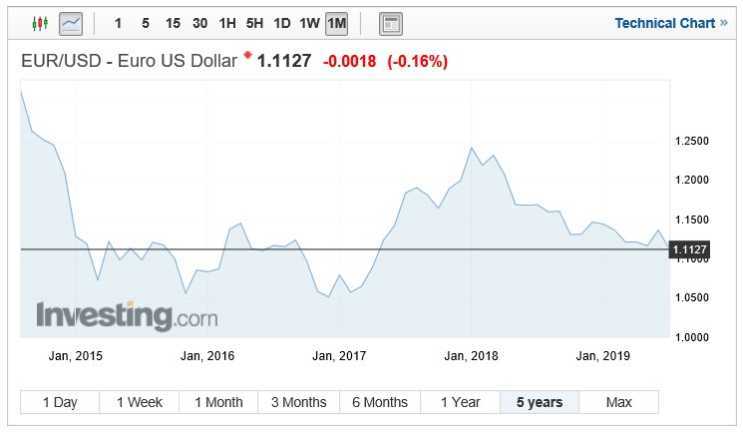

The Euro lost ground against a host of currencies with the EUR/USD falling to multi-year lows and highlighting the economies need for action in the face of the zones economic performance.

Eurozone economy

Its fair to say that the eurozone economy has encountered a few bumps in the road, condemning the Euro to its lowest level against the dollar since early 2017. Key protagonists include weak Business Climate Data which fell to 0.17 in June from 0.30 in May. The reading equating to the lowest number since October 2014 and showing a dramatic lack of confidence from participants.

Manufacturing production has also decreased notably, falling 0.6% compared to the previous year as the trade war would now be appearing to be taking hold and the threat of hard Brexit very real.

Inflation increased by 1.3% over the year, above the forecast level of 1.2% as services, alcohol and food have become more costly. As with many economies, the ECB has a target level of 2%, the challenge it faces is that it may have used many of the tools at its disposal to meet this level.

Despite many of the elements of the Eurozone economy seemingly waning Mario Draghi stated that he felt that the threat of recession in the area was modest saying; that the threat remained “pretty low”.

Overall the eurozone economy has accomplished modest growth this year confirmed at 1.2% in the previous quarter, equalling that of the last quarter of 2018. Comparatively the Brexit ravaged UK economy has achieved 1.8% growth and the flagship that is the US economy has grown by 3.2%.

When will the ECB intervene on interest rates?

It would seem, as was the case a month ago that the question is when and not if eurozone interest rates are cut. Fortunately for investors, Draghi has given the clearest clue yet that a rate cut isn’t far away. Saying that the outlook for the eurozone was getting “worse and worse” due mainly to the tension and uncertainty caused by Brexit and trade wars. Investors now believe that interest rates will fall under 0% in early 2020 if not sooner, with the ECB turning back on the promise of rates not falling below 0%.

Admitting that interest rates could remain at current of lower levels throughout 2020 highlighting that the European central bank would adopt a slow and measured approach rather than forecasting numerous rate cuts.

Euro exchange rates slump to 2-year lows

Whilst typically the avoidance of lower interest rates would normally provide support for a currency the lack of intervention to stimulate the eurozone economy was viewed poorly by markets and the EUR/USD staggered to a 2-year low.

The week low for the pair was 1.1106 following the Mario Draghi’s statement, the pair tumbling from a week high of 1.1224. the rate of 1.1106 last being traded in early 2017.

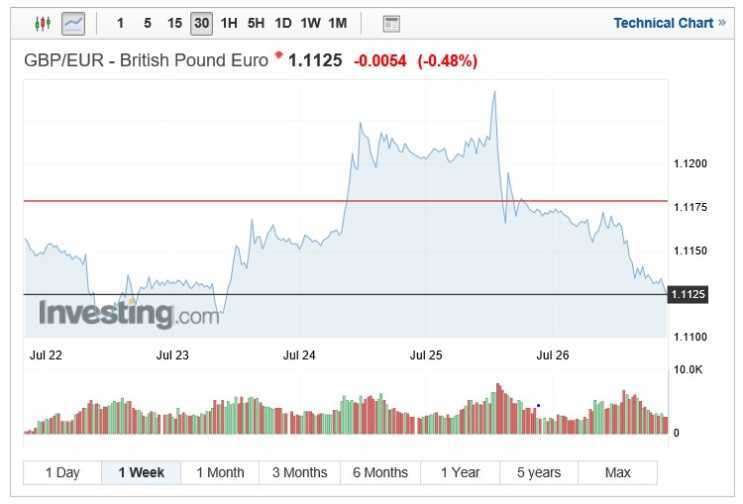

Despite the weakness in the single currency GBP was unable to conclusively gain with rates of between 1.114 and 1.1242 being traded over the last week. The UK and EU are due to lock horns again this week following the new prime minister forming his cabinet and promising the UK will leave the EU in October.

The Pound Euro pair raced to the week high, before the exchange rate fell significantly as the ECB announced that rates would be held at 0% promoting a correction in GBP/EUR.

The fall was further accentuated by the very likely possibility that Boris would have to call and win a general election in order to break the deadlock in parliament. A recent ruling meaning that the Tories wouldn’t be able to pass a no-deal Brexit through parliament and holding the government to provide updates on the progress of negotiations. The GBP/EUR pair closing on Friday at 1.1125.

Eurozone data this week

Key data releases for the single currency this week include German preliminary CPI, expected to reach 0.3%. Spanish flash GDP is anticipated to fall from 0.7% to 0.6% in the previous quarter. Eurozone flash CPI estimates are expected to show a year-on-year decline from 1.2% to 1.0% Core CPI is forecast at to reach the same number falling from 1.3% last year.