The eurozone posted a raft of impressive data this week which included positive services and manufacturing PMI numbers.

French and German services posted readings of 53.3 and 54.4 against targets of 52.5 and 54.1, both exceeding their anticipated levels. Despite these fears are growing for Germany’s economy which now appears to be on the brink of a technical recession.

Eurozone manufacturing data also surpassing estimated levels with German manufacturing PMI numbers reaching 43.6 against the forecast of 43.1.

The improvement in manufacturing and services was put down to a slight improvement in the trading scenario. As trade tensions between China and the US have intensified it would appear that Trump’s focus on the eurozone has for now at least alleviated.

Flash eurozone PMI grew at the fastest rate for 2 months outstripping its forecast of 46.3, reaching 47.0. Flash Service PMI also impressed reaching 53.4 against a target of 53.

German economy on the brink of recession?

Despite the encouraging data real fears for the German economy still exist. The underpin of Europe appears far from the machine it once was. Record unemployment rates and trade surpluses which have been enjoyed for the past decade now appear to be over and whilst harmful to Germany, the slow decline could be devastating for the rest of Europe.

Germany possesses deep supply chains across Europe and a slowing in German output highlights a slowing in European appetite and the US trade wrangling are now being felt everywhere. Manufacturing represents the largest part German GDP of any industrialist nation and therefore with global appetite slowing the effects are becoming more and more profound.

Likewise, this is a double-edged sword as US exporters now have to navigate potential tariffs and export to Europe which also has slowing demand. The very fact that German GDP is so reliant of manufacturing exposes it significantly to recession given the state of the global economy and Trump’s quest for protectionism.

Is France’s economy now outperforming the German?

The French labour market has improved dramatically in recent times with unemployment falling to 8.6% the lowest in a decade. This newfound labour force is fuelling internal growth with French citizens buying French goods. Wages are climbing at an average of 1% per quarter comparing favourably to Germany’s which increased by 0.65% and 0% in Italy.

Whilst Macron’s policies and persona have divided France it would now appear the policies are filtering through in the economy. French GDP expanded by 0.2% in the previous quarter and whilst that was below forecast it was inline with Eurozone growth expectations and larger than Germany’s and Italy’s, plus France’s economy which is significantly less dependant on exports than Germany’s should fair better in both a global slowdown and Trade war situation. The European Commission also forecast 1.3% growth in manufacturing output and only 0.5% growth from Germany.

Despite the encouraging headlines France’s economy is still one of the most indebted in Europe with a high GDP to debt ratio. Whilst Macron has attempted to correct this trend via social reform, he has been unable to break the will of the people and therefore his attempts have been half baked at best. On top of this, whilst the French economy might be showing encouraging signs a recession in Germany would almost directly impact its neighbour.

Euro exchange rates

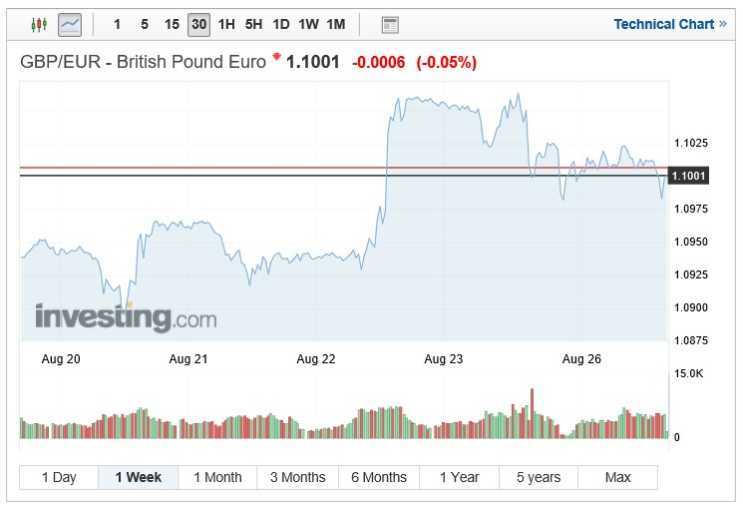

Despite the positive data headlines, the Euro was unable to gain against Sterling with the pound rising to a three-week high against the single currency.

A high of 1.1063 being treaded on Thursday, much fuelled Europe allowing Prime Minster Johnson the ability to provide another solution to the Irish backstop and providing a small amount of hope that a No Deal Brexit could be avoided.

EUR/USD was more impacted by FED chair Jerome Powell’s speech which took place in Jackson Hole than the recent data. A movement from 1.1079 to 1.1147 was witnessed following Powell’s speech where he confessed that the FED would be unable to repair the damage caused by a trade war stating;

“Trade policy uncertainty seems to be playing a role in the global slowdown and in weak manufacturing and capital spending in the United States, while monetary policy is a powerful tool that works to support consumer spending, business investment, and public confidence, it cannot provide a settled rulebook for international trade.”

The EUR/USD pair closed at 1.1142 on Friday with the pair initially enjoying further gains (Monday) before sentiment moving back to the dollar Interbank EUR/USD levels currently sit at 1.113.