US officials have announced that President Trump and Xi has agreed on a 90-day delay on further import duties on Chinese goods. Trump confirmed the dinner at the G20 summit had been productive claiming that the evening was “productive meeting with unlimited possibilities for both the United States and China”.

The 90 days affords the two superpowers valuable time to negotiate a trade deal and potentially avoid trade and currency wars whose effect would reverberate across the globe. One would imagine that a risk of attitude will return to equities market in the coming weeks.

As a sign of goodwill China announced the death penalty to anyone caught trafficking the synthetic opioid Fentanyl, the drug responsible for many of the 72,000 overdose deaths in the USA in 2017.

In a press statement after Trump’s departure from Buenos Aires, Sarah Sanders confirmed that Trump would not increase the tariffs on Chinese goods from 10% to 25% as planned in the new year. The White House spokeswoman confirmed that the two nations had discussed the purchase of goods from a number of US sectors including; energy, agriculture and the industrial sectors. Although the spokeswoman was quick to confirm that these deals had not been agreed as yet.

The Chinese government also hailed the talks as a success and stated that “The two presidents agreed that the two sides can and must get bilateral relations right. Discussion on economic and trade issues was very positive and constructive. The two heads of state reached consensus to halt the mutual increase of new tariffs.”

Xi apparently also is confirming he would consider approving a potential $44billion deal, enabling Qualcomm Inc to purchase NXP Semiconductors NV if proposed again.

Announcement market positive

Markets have been awaiting some positive movement on the USA Chinese trade deal following months of abandoned negotiations and threats. This weekend positive negotiation signals a good step forward rather than a breakthrough. The concessions proposed by China do however signal great willing to get the trade deal in place.

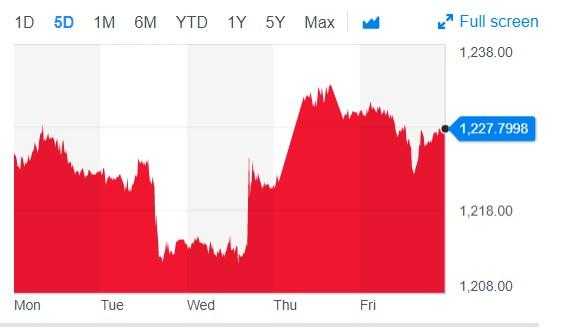

Markets had stumbled last week following comments from Fed Chair Jerome Powell, US bond yields fell which was followed by the Dollar index. This week’s announcement will almost certainly see the Dollar fall further as investors switch from the safe havens into riskier assets, notably equities. One benefactor from the lead up to the G20 talks had been gold, prices have been underpinned by the diversion away from the Dollar and gained around 1%.

Prices rose from 1,213.60 to 1,225.00. The price rise was sustained over the final trading day and 1oz Gold prices closed at 1,227.10.

Markets anticipate a further easing in Dollar values as more riskier assets will be selected by investors. Many analysts also anticipate further rises in gold as investors pare back Dollar investments further.

US Dollar forecast trumped by commodity currencies

The trade truce will provide a real shot in the arm for commodity-based currencies although less so than the stock markets, we anticipate currencies such as the NZ Dollar and AUD to rally in early on next week. Their close tie to the Chinese economy will see a higher demand for raw goods which will bode well for the NZD and AUD who enjoy close trading arrangements with China.

The EUR and GBP should also gain against the Dollar although remain suppressed by political factors such as Brexit, ongoing issues in France and poor data run for the Eurozone.

What are the next steps to US and China trade deal?

The apparent agreement to work together show great intent from both parties and could possibly pave the way for a trade deal to be formulated. The concessions offered by China will go along way in ensuring the new bout of negotiations being positive. This being said there are a number of issues which will need to be addressed including Trump’s concerns about Chinese intellectual property theft, notably the state-backed project ‘Made in China 2025’’ which plans to turn China into the leader in advanced technology.

Analysts, despite the willing and ceasefire, will remain sceptical. Dealing with Trump can be a challenge and his sentiment towards the possibility will almost certainly change as progress develops or stalls. In anticipation of the negotiations, he readied further levies.

The White House is calling for significant structural reforms to China’s economy in order to ratify a deal. Many deem these changes as implausible. Therefore, Trump will have to also potentially concede some points in the way China has begun.