Both due to its economic exploits and gregarious president, one can’t help to note the slight change of pace in the economy. Despite concerns about inflation and wages, the outlook would appear bright. We take a look at the key elements driving and holding back the US economy.

US labour market

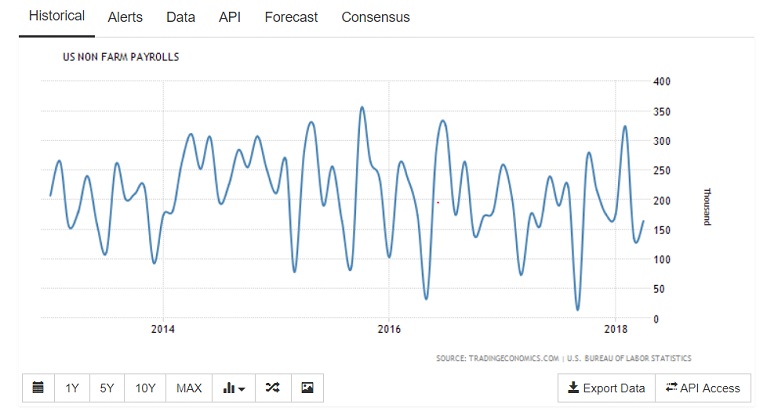

Once the shining light of the economy, the labour market has historically been used as the foundation for the FED in many of its monetary policies. Over the last 6 months US jobs data, notably the non-arms payroll has become a less dependable ally. The economic data measure has exceeded its forecast in just half of the last 12 readings, occasionally smashing its anticipated level however with unemployment at a 17-year low, or 3.9% it’s hard to be critical.

This month’s non-farm payroll fell short of the anticipated level. The US economy added 164,000 new jobs in April, against a predicted 193,000. This month’s figure far behind the previous which saw a bumper 313,000 added to the US labour force.

Although some may interpret the slightly more subdued numbers as an inconsistent anomaly we must remember that the labour market isn’t far from optimal levels. Areas of construction have also reported issues find new workers with appropriate credentials making recruitment harder.

Average earnings which had been a thorn in the side for the US economy are also gradually rising. This month’s average earnings showing a 0.1% growth in wages, falling short of the 0.2% predicted for the month giving an annualised rate of 2.6% slightly behind the estimate of 2.7% predicted. Regardless, economists remain buoyant over the condition of the US jobs market. Many expect the US unemployment level to drop to 3.5% this year a feat which remains tangible if an average 120,000 new jobs can be created over the year, in order to keep the balance with the working age population.

Manufacturing sector

Another sector which has also encountered issues recruiting due to the receding talent pool is the manufacturing sector. The industries sector represents roughly 19% of the US economies GDP, 12% represented by manufacturing. The most prominent measure of US Manufacturing is the monthly ISM manufacturing PMI.

This month’s figure has declined in the last few months. Last month’s estimate of 60.3 was missed, coming in at 59.3. This weeks worse still reached just 57.3 against a target of 58.4. The rationale behind this cooling was the recruitment challenges but also constraint due to the near capacity economy.

Supply managers also reported challenges due to the rise in raw material costs and the increased tariffs on steel implemented by President Trump. Regardless the sector is being underpinned by global growth and demand.

Despite the apparent slight dip in manufacturing is far from disastrous with any reading above 50 showing growth in the manufacturing sector. The sector should also be supplemented by the weak dollar, making buying US goods more cost-effective.

Financial market indicators

Quarterly stock market earnings have been strong despite some corporate earnings considered to be approaching near peak levels. In spite of predictions that Trumps recent tax cuts would see middle America head straight to their broker, it would appear that currently there are little supporting equity prices.

The potential of short-term interest rate rises has also contributed to the cautious approach to recent US stock market activity as well as various Geo political scenarios. These have included the introduction of the recent US trade tariffs and the increased tension between the US and China as investors believed the likelihood of a trade war was increasing.

The US debt mountain appears to have no end with worries that in five years’ time, the US could find itself in hotter water than debt-ridden Italy. Trumps infrastructure plans have been adding to woes and in turn the treasury department plan to increase activity in bond auctions. Auction sales are planned to be increased to $73 billion this quarter.

This month saw the US treasury borrow $47 Billion more than previously anticipated with total borrowing reaching $488 this quarter, the amount a new Q1 record.

Overseas investors are now shying away from the bond market with leaving US investors with the debt burden. Typically, when interest rates are going up yields fall, however currently interest rates are rising alongside yields. The worry is that investors will be deterred by from acting now, instead of waiting for rate rises. Therefore, the increase auctions value could mess up the supply/ demand balance.

Ten-year bond yields topped 3% last week the highest in 10 years. Concerns are that due to its increasing reliance on US investors, these investors could become more price sensitive and appetite decrease.

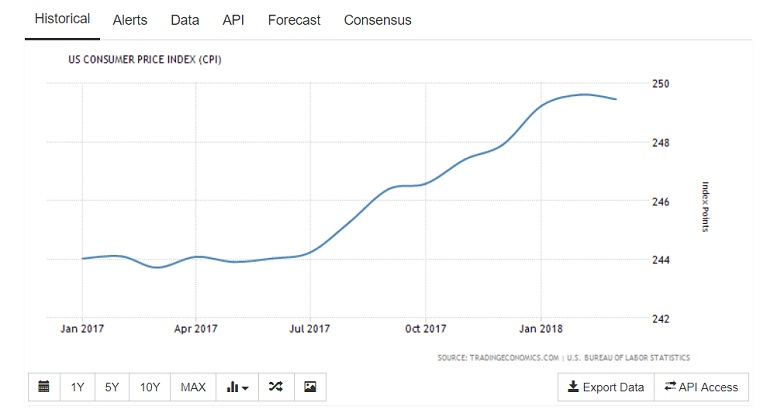

US inflation

In this weeks FOMC statement the Federal Reserve stated that US inflation was moving closer to the ideal of 2% which has put another interest rate rise on the table for June. The FED have insisted on the necessity of symmetry between rate rises and higher inflation. The latest US CPI data will be released next week, and markets anticipate that CPI will increase by 0.3% and Core CPI by 0.2% respectively. Last month’s figures showed that US CPI inflation increased rose at its highest level in a year. If this continues as expected there will be very few reasons to discourage the FOMC from raising rates in the next few months.

The issue will be when inflation begins to erode wage increases which in turn could affect consumer spending.

I did not have relations with that woman?

As we are more than aware hardly a week goes by without the US president being scrutinised or being embroiled in some sort of scandal. This week saw revelations that Stormy Daniels a porn star, was paid $130,000 hush money by Donald Trump’s lawyer Michael Cohen.

Although Trump had both denied the affair and knowledge of the $130,000 payment his cover has since been blown by Rudi Giuliani who has stated the president was aware of the payment. The former NY Mair who recently joined Trump’s legal team told Fox News that the president was aware and had recently reimbursed Michael Cohen.

Whilst unsavoury in substance the scandals real issue is whether Trump paid off Stormy Daniels with Campaign funds or Cohen’s own funds. If it is proved that campaign funds had been used to pay off a sex bribe, problems could mount for trump.

The dollar now recovering?

In recent months there has been a strong diversion away from the US Dollar, recently though the USD has mounted a comeback.

EUR/USD reached a high of 1.2421 in January as appetite for the dollar cooled both to the antics of trump, NAFTA rhetoric included and latterly the possibility of US-China trade war. The Dollar has fared much better recently, and its trade weight index has seen it climb against many of the majors. The boost assisted if not accelerated by the consistent Non-farm numbers.

Much of the dollars propulsion has been due to a weak Euro however if inflation increases next week the dollar will rise of its own merit as market maker begin to price in the next rate rise which could indeed be next month.

Conclusion

The US economy would appear to have switched up a gear and is being driven by real impetus. Although arguably offset by rising inflation average earnings are growing slower than desired. Inflation which once was the bane of the FED is slowly correcting, which in turn will support another interest rate rise, predicted as early as June. Although debatably the labour market is slowing, capacity is near the brim so therefore growth will continue just a more measured pace. Key challenges for the US economy will include finding a tariff resolution for key trade partners and keeping a lid on the mounting debt which continues to increase.

Trump remains a law unto himself, you get that feeling that whether scandals such his ‘questionable private pursuits’ or his suggested collusion with Russia – which is still very much an active investigation will dethrone him or not will be done to his team management. If the actions of Cohen and Giuliani are anything to be judged by it could be an interesting year for US politics.