The South African Rand fell significantly against the Dollar this week following the latest round of PMI which demonstrated a decline following two months of expansion. The drop has raised questions as to whether the South African economy is struggling to rebound following the recent political changes.

Manufacturing report – PMI disappoints

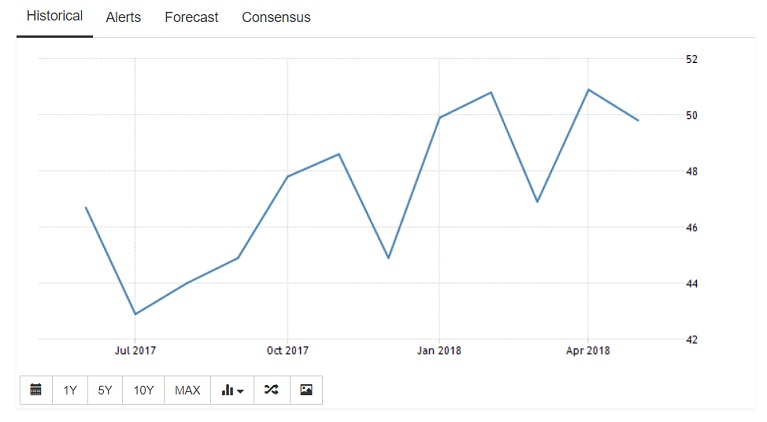

The Absa Purchase managers index works much in the same way as other PMI’s including those utilised by major currency nations. The signal for growth is a number north of 50 and contraction south of 50. The monthly report is collated by the Bureau of Economic Research (BER), which approaches purchases manager in South Africa.

The recent purchasing manager index showed a significant decline in South African productivity in May. The Absa PMI data missed the target, registering a decline from April’s figure of 50.2, a disappointing 48.9 this month.

Although behind estimations this quarter the Absa PMI data demonstrates growth over the first quarter of 2018. Investors therefore still remain confident in the South African manufacturing sector. This is furthermore endorsed by the level of averaged growth in the second quarter is 50.4, above the critical 50 mark and highlighting expansion in the sector.

Is the South African economic rebound failing?

Following the recent political issues which included Cyril Ramaphosa’s beating the previous President Jacob Zuma to become the ANC (check) leader and new President in December. Zuma; whose reign was peppered with corruption allegations, maintained a grip on power until mid-February before finally agreeing to stand down.

Zuma who finally succumbed to party pressure following 9 years of being president stood down reluctantly. In his departing speech he stated.

“I have therefore come to the decision to resign as president of the Republic with immediate effect, even though I disagree with the decision of the leadership of my organization”

President Zuma left the nation disillusioned by rumours of his corruption, with many of his business owner friends allegedly benefitting from his influence. A weaker economy and a tarnished image throughout the rest of Africa. His reign and undignified departure saw the South African rand plummet following a vote of no confidence in August last year.

The South African Rand touched a high against the US Dollar following Jacob Zuma’s departure from office. The pair reached 11.51 following Jacob Zuma’s departure from government, however, since the year high the South African Rand has struggled and lost roughly 10% since the presidential takeover.

South Africa stock market’s benefit

The US recently rejected South Africa’s application for a tariff exemption which many believe could now being reflected in arguably slowing manufacturing figures. Whilst that Rand has plummeted certain top SA indexes have rallied. The main benefactors being the Top 40 index which jumped to 57,282, a gain of 2.2%. ArcelorMittal’s a leading steel and mining company jumping 11% as sentiment leans towards locally sourced materials, due to the recent US Tariff challenges.

Concerns that Cyril Ramaphosa’s plans be failing

The recent Presidential changes were met with Euphoria following Jacob Zuma’s post which was echoed across the nation. However, in recent weeks the sentiment that his protectionist stance may now be affecting the economy has made people pause for thought. Investors are now becoming less optimistic about his plans and presidential credentials.

The recent PMI figures have also been exaggerated by concerns the global economy isn’t growing as quickly as expected. A volatile ‘leader of the free world’ who is also following a protectionist stance alienating key trading partners far and wide and potentially spoiling for an all-out trade war with China.

How the South African Rand performed against the USD

Following renewed confidence in the SA political and economic outlook in mid-February, the South African Rand has struggled against the US dollar. The USD/ZAR pair recovered from their year low in February (11.52) despite concerns around the USD and a Trade war with China and loss of trading partners. Following the latest Absa Purchase managers index, ZAR weakened further against the dollar with the USD/ZAR climbing from 12.4691 to 12.7260. The USD managed to hold on to roughly a 1% gain until market close.