The US Dollar has been sold off conclusively this week as talks were concluded between the US and China. The talks related to recent tariffs imposed by the US lasted 2 days with no resolution. The Dollar’s movements haven’t just been suppressed by the lack of positive talks between China and the US; the Chair FED also turned slightly dovish towards US inflation and insinuated that US interest rate hikes would be more gradual than markets had potentially anticipated.

Markets have also had to navigate the very real uncertainty that Trump might not see out his full White House tenure. The political uncertainty follows Trump’s longtime lawyer Michael Cohen pleading guilty to eight felonies, meanwhile, his former campaign manager has also agreed to eight federal felonies.

Trade talks between the US and China breakdown

The escalating tension which has toyed with global markets for the last few months was discussed this week in Washington as China offered an olive branch and flew to the US capital. Their decision follows the implementation of tariffs from both sides. Both parties are currently imposing hefty 25% tariffs on $50 billion of each other’s goods following the two days of discussions no breakthrough or real progress. Whilst its understood that both sides exchanged candid views about creating a fairer more balanced trade relationship a deal is far from being struck. Instead, both sides agreeing to keep in touch about a future deal.

Now the US is planning to implement a third round of tariffs on additional Chinese products which will total $200 Billion it’s difficult to envisage a deal happening soon. The next round of tariffs is planned to be implemented as early as next month. Trump is also outlining that he could tax all of the $500 Billion imported into the US from China. The possibility of an all-out trade and currency war is becoming more and more likely.

Although typically reserved and passive the Chinese finance minister responded during an interview with Reuters this week. Mr Liu Kun dubbed the US demands as ‘unreasonable’ continuing he stated:

“China doesn’t wish to engage in a trade war, but we will resolutely respond to the unreasonable measures taken by the United States.”

“If the United States persists with these measures, we will correspondingly take action to protect our interests.”

Trump’s objectives to make trade easier for US producers in the US by pricing the competition arguably are taking effect. Despite some slightly below par data the US economy is dooming and middle America’s new spending power is being reflected in a booming stock market. Unemployment is at its lowest level in decades and the jobs market is at capacity.

Jerome Powell indicates more gradual interest rate rises

Another jolt was seen to Dollar strength this week at Jackson Hole with an uncharacteristically dovish statement from the FED chair Jerome Powell. The speech which is held annually in Wyoming catching markets off guard. The chair essentially highlighted that the economy wasn’t overheating and therefore no further interest rate hikes were currently required. The FED will, therefore, adopt a more slow and gradual approach to interest rate hikes. Whilst analysts still believe the US economy is ripe for a further interest rate rise in September, the picture on a December interest rate rise is now slightly clearer.

Other experts were left understanding that if a rate rise doesn’t go ahead in December it almost certainly will in January. Recently Trump openly commented on FED rate rise policy openly disagreeing with the FED’s policy. The question will now be as to whether the FED is being led or mildly swayed by the President’s comments and Twitter outbursts. Trump openly expressed that he felt interest rate rises could harm the US economy’s progress, promising to continually criticize the central bank until it rethinks its strategy. Trump’s unorthodox approach is being viewed as meddling with the FED, consensus which typically is kept separate from political policy or interference face from the white house.

Uncertainty as former Trump aids turn informant

As the president was turning the heat up on the FED, former campaign managers and legal aids were turning against the President. Michael Cohen turning witness and admitting to eight felonies, these ranging from tax fraud to making incorrect statements to financial bodies. The most troubling of admissions from Cohen will be his admission that he paid hush payments to Stormy Daniels and Karen McDougal for an ‘unnamed presidential candidate’ and acted upon the candidate’s guidance.

Michael Cohen also admitted the payments were for the principal purpose of influencing the election. The probability that Cohen will now divulge further information and assist Robert Mueller’s investigation has heightened dramatically in recent days. Michael Cohen is expected to serve between 4-5 years in prison after agreeing not to challenge any sentence. He awaits sentencing on the December 12th.

Whilst Cohen pleaded guilty just 200 miles away in Virginia the President’s former campaign manager also admitted his guilt to eight further felonies. These include tax and bank fraud, meaning Paul Manafort now faces living the resting of life in jail, unless pardoned by Trump.

If the Democrats were able to win the house of representatives in November they would be able to launch an operation to impeach the president, with this week’s cases almost certainly being used as collateral.

The Dollar Index (DXY) falls

Whilst markets and Dollar exchange rates tend to remain fairly resistant to Trump’s politically induced weakness this week has seen a slump in the Dollar. The Dollar index falling to a week low of 94.95, it did recover somewhat before tumbling again as news of the unsuccessful US-China trade talks and the real possibility of Trump being impeached reached print.

The US Dollar has also been devalued against the Euro with the EUR/USD climbing to 1.1628 a level which found support. The pair recovered from a week low of 1.1398.

Even lacklustre GBP enjoyed against the US dollar with Cable rising from 1.2801 and touching a week high of 1.2866, before closing trading on Friday at 1.2849. Experts believe that sterling could see further gains next week following its rapid depreciation against the USD in recent weeks. Experts claim that 1.2750 will be a critical level of support for GBP whilst the longer-term trend could reach 1.30.

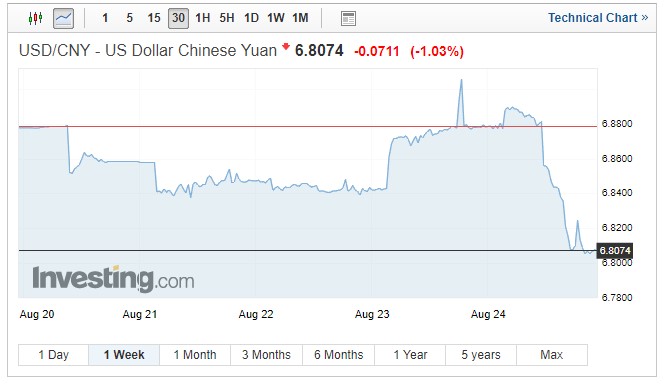

The Dollar was also sold off against the Yuan following the Jackson Hole Symposium as the FED turned dovish, however, a sell-off was seen before the announcement with USD/CNY falling from 6.8813 to 6.8079.

Featured image: © Akarat Phasura – stock.adobe.com