Partly assisted by the outcome of The Jackson Hole symposium which took place in the hours that followed, the Australian Dollar enjoyed a slight lift as Scott Morrison was elected the 30th Prime minister of Australia this week, Morrison succeeded Malcolm Turnbull who had faced two leadership challenges in recent weeks.

Liberal party leadership challenge

A leadership contest began following revolt in the centre-right Liberal Party. Subsequently, Morrison’s election means the Australian people have had six Prime ministers in around a decade. A leadership race was initiated by another candidate Peter Dutton following inner-party squabbling. The points of contention included the tension between Turnball and Dutton. Dutton; an ex-police officer when interviewed was adamant he could do a better job than Turnbull. Whilst no particular incident marked Turnbull’s downfall a host of key cabinet members offered their resignation which led to a cabinet ’spill’ or leadership challenge.

Despite Dutton’s ambition and appetite for the post of Prime minister, eventually, Scott Morrison won the leadership spill with the final vote being clinched 45-40 in Scott Morrison’s favour.

Following his election and being sworn in, Morrison pledged to be the Prime Minister who is ‘’on your side.’’ Graciously acknowledging the outgoing leader, he thanked Malcolm Turnbull for his contribution to the country and described him as a great Australian.

Upon the announcement, Malcolm cited the party’s greatest achievements as tax reductions, same-sex marriage and Australia’s jobs market growth. He demonstrated his displeasure towards those who had led to his downfall, describing them as creators of chaos. Turnbull is expected to leave the party and stand down shortly.

The continual electorate change has fuelled a sense that the government is focusing more on internal politics than actually running the country. Morrison’s election marking another internal shakeup, the sixth elected prime minister in a decade and the fourth which has been dismissed by their own political party.

What is Scott Morrison looking to change?

Overall nobody expects Prime minister Morrison’s policies to be wildly different from Malcolm Turnbull’s. He is known as a moderate, despite this moderate overtone Morrison did create the contentious Asylum seeker policy which saw boats full of immigrants being turned away from Australia. Morrison also ensured that he wished to bring the party back together.

Political experts have also criticised the replacement, whilst many agree the party had been losing favour with the Australian people, it remains to be seen if Morrison will be viewed as a popular replacement, raising questions as to whether the party find themselves in a stronger position for the next federal elections.

Australian Dollar movement this week

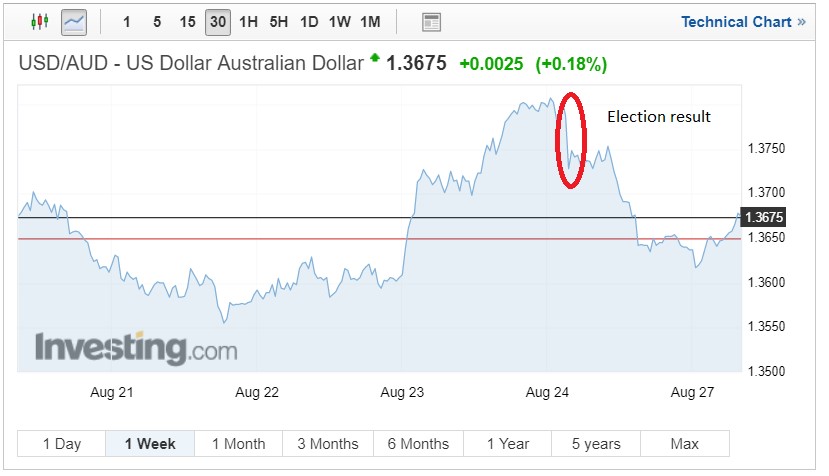

Whether Morrison will prove popular or not with the Australian people is yet to be seen. The move regardless proved popular with markets and has seen the Australian Dollar receive a level of support. USD/AUD has fallen slightly since the announcement, the pair falling from 1.3803 to 1.3728 following the announcement, however, USD losses have continued and currently, the pair is trading at 1.3674. Although much of this can be attributed to the FED’s more Dovish tone at Jackson Hole.

More moderate declines were seen on GBP/AUD charts with the currency pair falling from 1.7677 to 1.7595 a rate which has remained relatively stable. Currently, the pair is trading at 1.7554.

Australian Dollar forecast

Despite the AUD receiving a boost from the election of Prime minister Morrison, there are very few reasons to buy AUD currently. USD/AUD is just a few cents off its 2016 high. The widening of the US interest rates adding to the AUD downfall, closely followed by the continual political merry-go-round. Tariff wars also throw further uncertainty on the AUD, especially due to its close relationship with China. Growth concerns surrounding China remain very real meaning the demand for Australia’s raw materials is far from guaranteed to continue at the same rate. Markets will now look to Prime minister Morrison’s new Government for more continuity and stability before the AUD starts to make notable progress.

Featured image: © enjoynz – stock.adobe.com