Sterling exchange rates picked up the pace finally as hints that a deal could be struck emerged between the UK and EU emerged this week. Whilst the divorce settlement and Irish border issues still remain problematic it appears a deal could have been struck on UK financial services post-Brexit. The progress on talks was highlighted by Dominic Raab who apparently now believes a Brexit deal will be reached within 21 days.

A letter to the Brexit select committee dated 24th of November, written by Raab claimed that negotiations had seen a ‘great deal of Progress’ in recent weeks. New British-led solutions to the Irish border had been lodged. historically this issue has been a real stumbling block for both parties, it is now however understood that an agreement on the border could be around the corner. Therefore, the possibility of an amicable ‘soft Brexit’ outcome would appear a lot more tangible.

Financial services deal in sight?

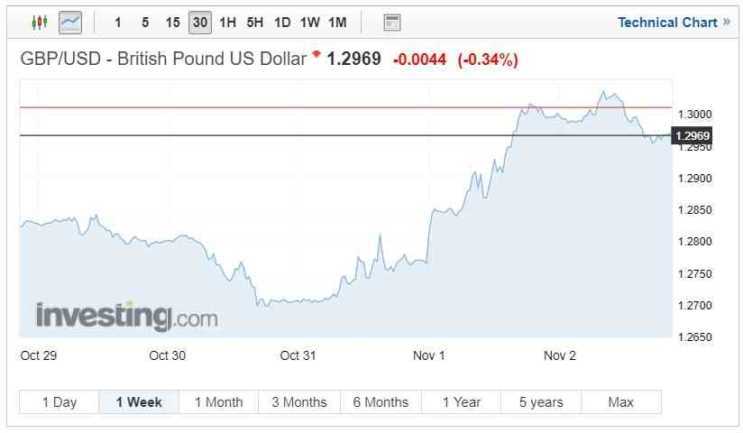

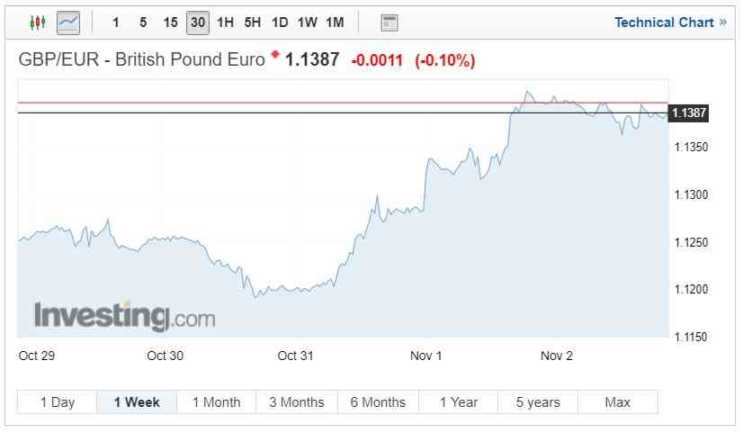

Sterling rose dramatically following news that the UK could have sealed a deal to retain access to European Union markets. As the UK’s economy is so heavily bolstered by its services industry, notably financial services the potential of access to EU market could prove invaluable to future growth. This positive news was reflected in Sterling exchanges rates which saw their second largest gains if the year so far with GBP/EUR heading towards 1.14.

The probability of a ‘deal’ outcome

Following Dominic Raab’s recently published letter to the Brexit select committee, UK citizens could be forgiven for believing that a no deal outcome could be avoided. The Financial services deal could be a real feather in the cap for the UK economy and welcomed warmly by Governor Mark Carney who also spoke this week, delivering his interest rate outcome.

Bloomberg stated that the S&P no believe that the probability of the UK crashing will now begin to be of detriment to the nations credit rating. The rating agency believing a No-deal EU exit could provoke a mild recession and further plunge in Sterling exchange rates, similar to those seen in the early parts of last week. Despite the agency’s guidance, news has been more encouraging recently, especially as Raab is to be taken on his word that a deal could be found within the next few weeks. Whilst the mathematical probability on a Brexit outcome is almost impossible to calculate, London property company JLL now believe there is a 90% probability of a deal being struck with the EU and have forecast, despite stamp duty pressures and political party uncertainty that the London market could leapfrog by 15% in value over the next 5 years.

Bank of England outlook lends a hand

Whilst as is no commonplace Brexit has dominated the headline. This week however also Mark Carney and the BOE contribute to Sterling’s ascendancy. Whilst the Governor of the Bank of England did heed the usual warnings about the potential of a no deal outcome on the UK economy he also assured markets that banks were ready and could cope. Carney openly stating:

“We feel quietly confident in the prep of the banks and financial institutions in the UK” continuing Carney said.

They have adequate capital, they have more than adequate liquidity, they have contingency plans. The outstanding issues largely relate to cross-border issues.

In terms of interest rate change markets anticipate the next rate rise in the UK will be next year and will almost certainly be subject to the UK economy’s Brexit outcome. Growth forecasts were revised down due to the implications of a no deal outcome. 2018 growth forecasts were lowered from 1.4% to 1.3%. Growth expansion in 2019 is expected to tick slightly higher with a forecast of 1.7%. The latest interest BOE rate vote was unanimous and means rates remain at 0.75%.

Sterling exchange rates rise at the second fastest rate this year

Recently Brexit rhetoric hasn’t been great, but this week has delivered a huge swing in the favour of sterling. GBP to USD exchange rate has risen significantly with the pair gaining roughly 1.89%. The circulating news about a potential financial services deal proving the pair to jump from 1.2767 to 1.2853. the gains this week have been sustained with the pair hitting over a month high of 1.3038.

The supersolid non-farm payroll numbers are offering much support currently as geopolitical scenarios take precedent. The US and China are once again sitting down to attempt to thrash out a trade deal, despite this Trump still remains finger on the trigger to implement further tariffs on remaining imported Chinese goods.

The GBP to Euro exchange rates have also enjoyed a gasp of air and at point threated the 1.14 level. Markets closed on Friday at 1.1387 with a weak high of 1.1410 being seen following news of a potential financial services deal.

Sterling also enjoyed gains against a handful of other currencies but has struggled against antipodean and commodity currencies with the GBP/NZD, GBP/AUD and GBP/ZAR all unable to benefit from the developments in Brexit.

GBP/CAD has however enjoyed an uptick in strength rising from a week low of 1.6662 to a week high of 1.7035. The pair closed Fridays trading session at 1.7001 with many believing GBP could strengthen further against the Loonie.

Can Sterling exchange rates hold on to their gains?

Whilst sterling bulls will have enjoyed the recent GBP gains many will be cautious due to the fact they have typically short lived. Despite Raab’s recent correspondence and claim that a deal on financial services is all but done has been angrily refuted by Michel Barnier.

Barnier has been quick to comment stating that the recent claims from the UK – EU deal providing access to EU markets is misleading. Taking to twitter the EU’s chief Brexit negotiator said:

Despite the polite warning from Barnier, it would appear that Sterling has support and therefore financial markets do indeed believe a deal is likely and potentially on the horizon.