The Pound Sterling to US Dollar rate hit a one year high this morning following the release of the latest UK inflation Figures.

The Consumer price index (CPI) was anticipated to show that inflation was on target at 2.8% however it exceeded target reaching 2.9% and put the question of rate rise back in focus.

Key Contributors to the Rise in Inflation

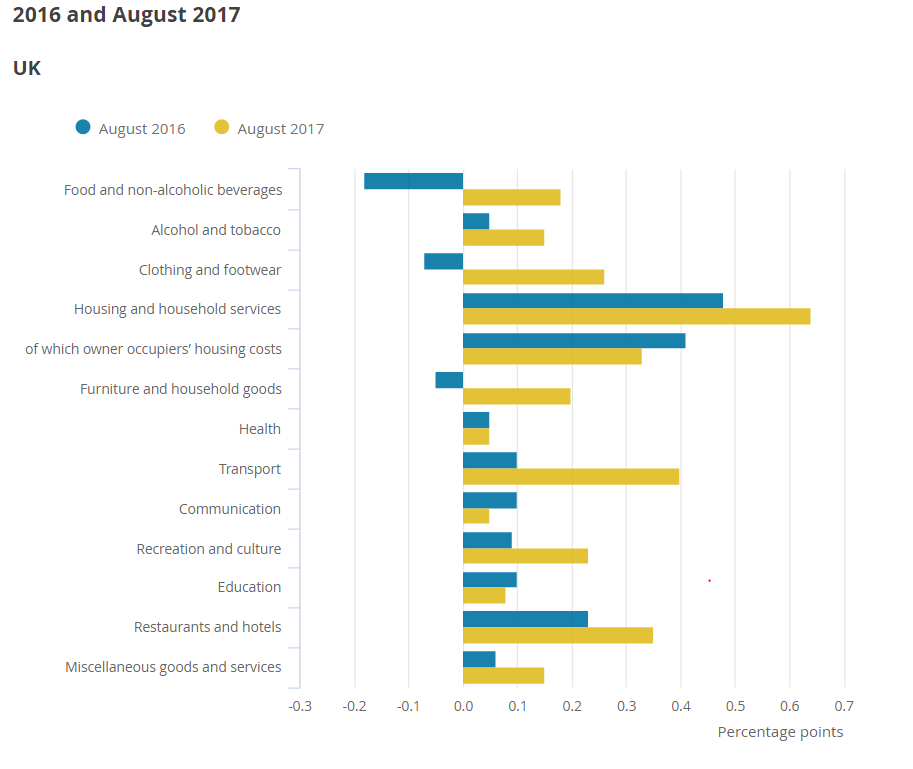

The main contributors to the inflation rise which as mentioned is up 2.9% on last year included clothing costs and fuel; resulting in inflation creeping away from the Bank of England’s ideal of 2%. Many of the rises are attributed to the drop in Pound Sterling since the EU referendum outcome. Oil; whilst often priced in Dollars has also risen globally in cost. The CPI data matching its highest level in four years.

Is Inflation Now Becoming an Issue for BOE Policy Makers?

The rate at which inflation is rising will add a further dilemma for the Bank of England to ponder. As the BOE remains cautious on interest rate decisions, due almost entirely to the many uncertainties which Brexit will serve up. Many expect a hawkish and restrained tone from Mark Carney on Thursday in order curtail Financial Markets ambition for an interest rate hike.

Pound Sterling Gains This Week

Pound Sterling surged to its highest levels in a year following the announcement, however the GBP had enjoyed solid gains all week. At its peak GBP to USD touched 1.3288 rising from 1.3204. The GBP/USD currently sits at around 1.3270 with the currency pair appreciating in excess of 0.8%.

Pound Sterling also enjoyed positive movements against the euro briefly touching a six-week high of 1.1125. With Pound Sterling enjoying sustained gains following UK Member of Parliament’s support of a European Union withdrawal bill and the latest CPI data numbers. Currently the GBP/EUR sits at around 1.1094 having risen 0.76%.

Week Ahead for Pound Sterling

As covered above the key movements for Pound Sterling could be fuelled by what is said by Mark Carney and his interpretation of the latest CPI figures. Despite MP’s recent approval to move on the UK’s bill to cut ties with the European Union, there remain many political obstacles which will need to be ironed out. Notably the negotiation and whether or not Theresa May will see out her reign. With reports today saying that the European Union wish for May to openly debate Brexit with 751 EU MEPs.

With Carney eluding last month that the UK could envisage more than one interest rate hike over the next three years. Many expect the soonest rate hike would occur in the third or final quarter of 2018. Therefore, any change of tone or thought process could prove decisive for Pound Sterling this week.