Markets had a keen eye on Friday’s data with a series of impactful US data releases scheduled. The train-like momentum of the US jobs market had been slightly more questionable of late. The last two readings missed target falling short of forecast, investors were looking to see if the last few months had been a loss of momentum or the beginning of a downward trend.

Following the release of the US non-farm payroll numbers was the ISM manufacturing PMI, the leading barometer for the health of the US manufacturing sector; any reading less than 50.00 indicates contracting in the US manufacturing sector, higher demonstrates expansion and typically buoys the US Dollar.

US Non-farm and ISM manufacturing PMI data releases were also accompanied by other consequential data including the US unemployment rate which remained relatively steady at 3.6% rising 0.1%, whilst average hourly earnings which fell 0.2% in October.

Non-farm payroll numbers surpass market expectations

New US job roles were able to offset the slowdown of the jobs caused by the strike at GM motors and hiring was stronger than expected. In total 128,000 were added to the US economy, well over the anticipated 90,000.

In recent months General Motors have made 50,000 people redundant and others have been subjected to pay cuts. Rumours indicate that up 100,000 could be affected by the layoffs and pay cuts. Although only fractionally, unemployment in the US increased slightly.

US unemployment remains on target

Unemployment in the US still remains at decade long lows increasing just a fraction from 3.5% to 3.6% in October. The labour department stated that the slight increase was due to an influx of new labour in the market. A positive sign for the economy which demonstrates confidence in the jobs market.

Whilst many US investors will have found solace in the US unemployment and non-farm payroll numbers a sector which has taken a beating of recent is US manufacturing. This was highlighted once again in Octobers ISM manufacturing PMI numbers.

ISM manufacturing numbers

ISM manufacturing numbers offset any positive momentum provided by the latest non-farm payroll data. The reading which was forecast at 49.0 reached met just 48.3 showing contraction in the sector.

The number condemned the sector to the third month of contraction since august. The drop which could be skewed or contributed to by the GM strikes paints the sector in poor health and highlights a trend rather than a blip.

A larger contribution to the decline in the sector is the escalation of trade tensions between the US and China in previous months. Despite this, the data investor will find some confidence in the fact that although in decline, the drop is less than many could have feared.

The ongoing negotiations between the US and China would also appear to be in a better place than they previously were. Although many still believe that when steps forward are made, they are typically followed by backward ones. However, it is understood that the two superpowers could be close to signing a truce.

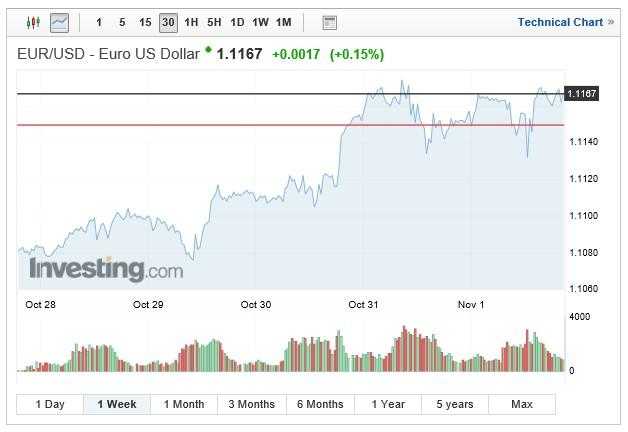

EUR/USD movement following the data

Despite the generally positive data run on Friday the EUR/USD has continued to gain ground in the US trading window. The single currency increased gradually against the USD following the FED rate cut last week. The Pair increased from a low of 1.1076 to a high seen on 1.1174 on Thursday as markets anticipated bad news from Friday’s data and investors diverted away from the USD.

The pound also enjoyed the fruits of tepid US data with the pound touching 1.2970 on Friday but falling short of testing 1.30. The pound’s strength is at times hard to understand, the polls currently support a lead for Boris Johnson, however, Corbyn shouldn’t be underestimated by markets as he is a proficient campaigner and seems a more tangible candidate for Remainers than the liberal democrats. Trading of the GBP/USD pair closed at 1.2935

This week’s Key US Dollar data

Key data for the US Dollar this week includes ISM non-manufacturing data, forecast at 53.4 rising from last month’s reading of 52.6. The index measures non-manufacturing business activity and is provided by supply managers.

Another piece of US data to look out for this week is the Michigan consumer sentiment index, due for release on Friday. The index is anticipated to increase from last months reading of 95.5 to 96.0.