The Pound was driven higher this week as polls indicate that Prime minister Johnson will seal a majority in next weeks general election. The Pound has seen good levels of support, with investors now believing that the victory is now Johnson’s to lose. Pound levels have hit year highs against many of the majors including the Euro.

What do the polls say?

Polls can vary slightly, however, one fact doesn’t seem to vary; the conservatives appear to firmly be in the driving seat. Barring any mishaps or scandals, Boris should be remaining in Downing street after next week.

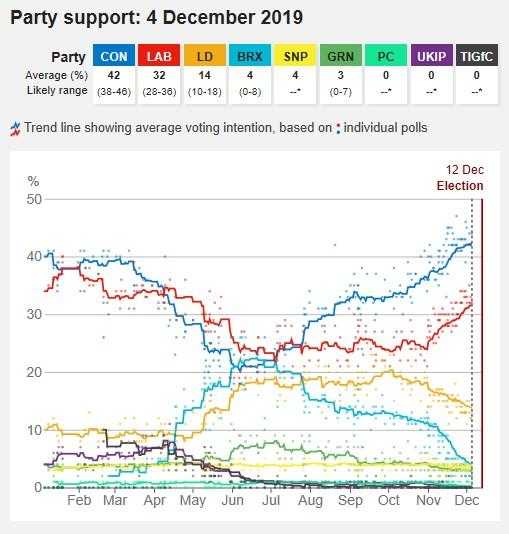

Currently, polls state that the conservatives are favoured by roughly 43% of opinion polls with Labour having 33% of the electorate support. Both the Liberal Democrats and the Brexit party have seen support wain with the Liberal Democrats having just 13% of the support.

The Conservatives impressive lead comes despite Boris Johnson’s admission that there could be checks on goods moved between the UK and Northern Ireland and that the conservatives pledge on increasing nurse numbers by 50,000 including retaining 19,000 current NHS nurses. Despite his opaque approach to these manifesto points some polls still believe that the Conservatives hold roughly a 15 point lead.

The weekend’s leaders’ debate

The polls would have almost certainly underpinned the polls, with Johnson appearing by far the more comfortable on discussing his position on Brexit and the deal his government has made with the EU. Corbyn received criticism of historic support for Sinn Fein and the IRA with members of the audience jeering when the topic arose.

Other topics the party leaders debated included national security, the NHS and Northern Ireland.

Both leaders were quizzed by a student nurse on how they planned to deal with NHS nurse’s shortages. Johnson replying by “encouraging nurses from overseas’’ and ‘’ shortening visa times and reintroducing bursaries for training’’.

Corbyn simply stated that under a Labour government “£40bn would go into the NHS in order to fund it properly’’

Although many commentators believe no knock-out blows were landed. Boris’ integrity was once again questioned as was there fact that no actual trade deal has as yet been made with the EU. Leaving the possibility of a no-deal Brexit still tangible.

Whereas Corbyn was grilled on his failure to state whether he was for leave or remain, and the fact that he thought his party could cobble together a better deal despite still wanting to hold another referendum on the EU.

Why is the majority so important?

Whilst the Conservatives are seemingly enjoying a solid lead, you are unlikely to see Boris Johnson and his constituents resting on their laurels this week. The Tories have been stung by opinion polls before and this week and need to ensure momentum is kept up to ensure a working majority.

A hung parliament or win by the Labour party would be awful for the Pound, plunging the economy into more uncertainty and compelling voters to choose Remain or leave with an as yet unbrokered deal.

However, if the Conservative Party could secure a majority government, they could push through their current Brexit deal, begin to negotiate a trade deal with the European Union and initiate negotiations for other trade deals. Whilst there are zero guarantees that the UK would secure a trade deal with the EU it wouldn’t appear advantageous for either to leave without a deal. The majority would give the conservative the ability to get the right number of votes in order to progress rapidly and address the element of the UK which have been neglected.

Pound surges as Conservatives lead polls

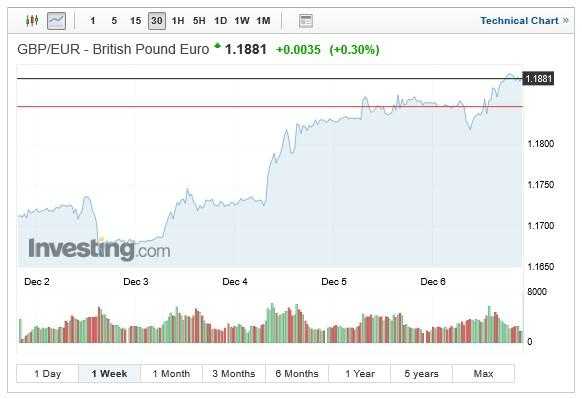

The possibility of the Pound securing the all-important majority has seen GBP/EUR touch year high’s this week with the pair fast approaching the 1.19 level. The week low of 1.1666 was blown away on Monday as opinion polls indicated more and more momentum behind the conservative party’s campaign. The week high touched 1.186 with a small sell-off seen in GBP in the run-up to Fridays hotly-anticipated leaders’ debate.

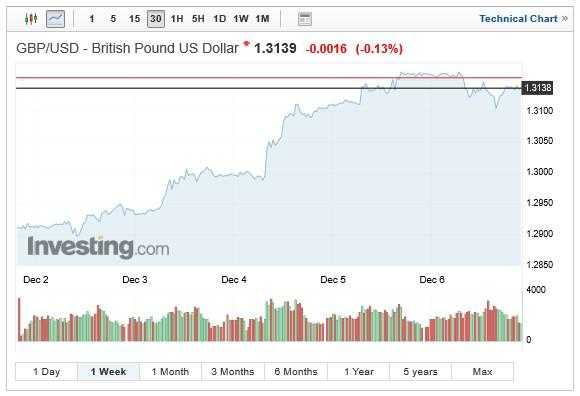

Cable has followed a similar route with just short of 1-year highs being traded on Friday with a small decline witnessed following the bumper Non-Farm payroll numbers. GBP/USD gaining from the week low of 1.2900 to a high of 1.3163 before US market close on Friday with the pair ending the week on 1.3138.

Investors will now await on the opinion polls reaction to Johnson admission on the NHS nurse numbers and the clarity that check would be performed between the UK and Northern Ireland, if these are shrugged off by markets and Conservatives lead the charge rate could breach 1.19 GBP/EUR and GBP/USD could climb to in excess of 1.3250.