Key currency pairs twinned with GB Pound exchange rates remained relatively calm this week. However, political tension between Russia and UK has been far from tranquil.

What we know about the attempted nerve gas murders in Salisbury

The police were made aware of the attempted Murders of Sergei Skripal and his daughter Yulia when passers-by noticed the two in distress on a park Bench in Salisbury. The pair had attended a local restaurant in the afternoon where traces of the nerve agent have since been discovered.

One witness who is believed to have first discovered the pair on the park bench described the two as being frothing at the mouth with their ‘’eyes wide open by completely white’’.

A local doctor who also witnessed the couple in distress and attempted to assist said Ms Skripal was slumped unconscious on the bench and had lost control of her bodily functions.

Since the discovery of the father and daughter pair in the park, the cathedral city has been transformed into a scene from a biohazard movie with specialist police units combing the area for clues.

UK police and anti-terrorism units have confirmed the identity of the nerve agent as Novichok, remaining confident in its links to the Kremlin.

The Kremlin has denied Novichok’s existence, claiming that no such program existed and that Russia no longer possesses chemical weapons.

Alexander Shulgin; Russian ambassador to the Netherlands claimed:

“There has never been any programme under the group name ‘Novichok’ in the Russian Federation”.

Continuing the diplomat said…

“Back to 1992, Russia stopped all the activities in the area of military chemistry.’’

A claim which seems positively farcical considering the Alexander Litvinenko assassination in 2006 which was linked back to the Kremlin after over a decade of thorough investigation from the UK police.

The Kremlin refutes Russian guilt

Whilst seemingly battle lines were being drawn between London and Moscow Putin and his entourage remained typically defiant. Rhetoric from the Kremlin has remained defiant this week with Russia even accusing the west of fabricating the incident, insinuating that the nerve agent could have come from the local Porton Down Military laboratory.

Kremlin spokesperson Dmitry Peskov stating

“Sooner or later the British side will have to present some kind of tangible evidence. Sooner or later we will have to move into the area of supported accusations, and not just insinuations.”

The UK continues to work alongside the Organisation for Prohibition of Chemical Weapons in order to progress the case against Russia. Whilst the organisation hasn’t directly engaged with the media it has stated:

“As was stated by the UK authorities, the OPCW offered technical assistance for the UK’s investigation and the OPCW expects some action will be taken soon.”

Theresa May acts – Russia condemned globally

The evidence of the Kremlin’s involvement has provoked a reaction from the UK prime minister and global condemnation. In a united statement the US, UK, France and Germany described Russia’s actions and attempted deniability as:

“no plausible alternative explanation” and “a pattern of earlier irresponsible Russian behaviour.”

The press statement was followed by a solo speech from the US where it blamed Russia for interfering in a number of US departments via malware uploading. The departments affected included, Nuclear department, critical manufacturing and water. Sparking fears of the development of cyber warfare.

Theresa May’s decisive action was announced in parliament once certainty was established. Her action against Russia included the expulsion of 23 Russian diplomats all of which had been identified and undeclared spies.

The exclusion marks the largest singles spy expulsion in over 30 years and will surely be followed by further global actions.

The prime minister also pledged to take action in order to take action against all forms of hostile activity in the UK, she confirmed she plans to take more action against high-level interaction between the UK and Russia.

May also confirmed she has requested the government amend the sanctions bill against states that violate human rights.

The prime minister also confirmed plan to freeze UK based Russian assets and plans to monitor travel to the UK for those who may be travelling to the UK with intentions that could harm the UK of its allies.

Russia retaliates against Theresa May’s action and planned steps

The Kremlin needed little time to react, also expelling 23 Russian located diplomats and closing the offices of the British council in Moscow.

The Kremlin has advised that the exclusion of 23 diplomats, most of which are also believed to be intelligence officers, is purely to reach numerical parity.

Russia continues to deny any involvement and has launched its own investigation into the Skripals poisoning.

Effects on financial markets and pound exchange rates

The continually developing volatile scenario has taken effects on a host of financial markets. Whilst many anticipate that further UK sanctions will be placed on US bank the real tipping point for Russia will come if or when the US and May’s other allies also implement sanctions.

Whilst a number of Russian oligarch’s hold property of London many reside in areas such as Israel and Cyprus and perform very little cross-border trade too from the UK.

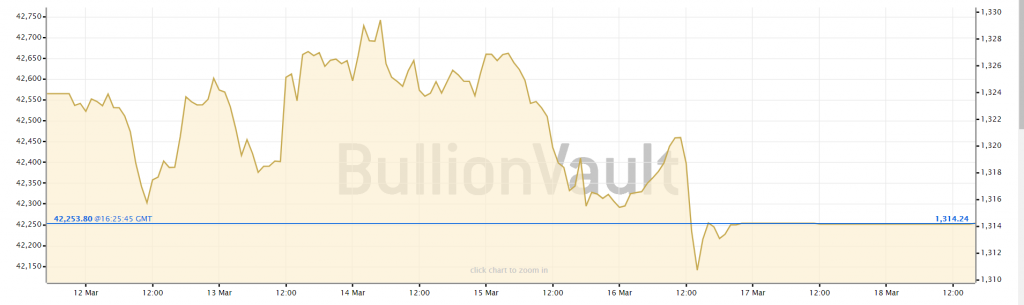

Last week Gold spiked to a week high in the wake of the tensions as investor sought the comfort of safe havens.

Gold prices have eased incrementally as global support for the UK has been voiced. NATO’s support for the UK’s action saw Gold prices fall to a two-week low against the dollar, the move assisted in part from the strong US industrial output.

Russia meanwhile is planning on selling $7BN of Bonds into the European market, many of which have branded the proposed sale as another defiant move.

Regardless of brewing tensions GB Pound Exchange rates have performed well. GBP/ EUR exchange rates have performed well with GB Pound exchange rates lifting above 1.13 this week.

GB Pound exchange rates have been lifted following the Spring statement which saw the UK announce a fall in UK debt and rise up the UK’s modest growth from 1.4% to 1.5%.

The GBP/EUR exchange rates traded between a range of 1.1242 before climbing significantly and closing on a week high of 1.1346.

Safe havens such as the Japanese Yen have Swiss Franc benefitted during the spat as investors sought cover towards the close of the week.

GB Pound Exchange rates forecast remains positive as the Brexit outlook appears to be slightly more positive.