While issues and certainties surround the future of global trade and Italy’s deficit target remains a real point of contention the ECB confirmed it is on track with its monetary policy. In the latest ECB policy meeting minutes, Draghi confirmed that the Central back would wrap up its €2.6 trillion Euro bond-buying program this year.

On course to wrap up QE

The European central bank’s plans remain on course, with the €2.6 trillion asset purchase program on track to be disbanded at the end of the year. Whilst the risk of global trade wars remains prominent and could potentially slow growth in Europe, the ECB remains confident in the domestic Eurozone economy and believes the buoyancy of the local market is enough to justify the current policy.

Global trade and growth worries

Whilst the risk of the global trade protectionism remains very much in focus, the ECB remains confident of the local market. As the trade war intensifies between the US and China and both continue to implement import tariffs the global outlook begins to look a lot bleaker.

The IMF this week announced that it believes global growth has stopped and is now plateauing with the fund cutting back its forecast growth expectations for the first time in over 24 months.

A consideration is that whilst the ECB believes that the impact of the current trade war remains manageable or can be offset by domestic growth, a growing worry must be that the ECB may have very little say or power in controlling it. As Donald Trump’s plans begin to affect the Eurozone more, how will the zone be able to offset the side effects? Especially as growth was downgraded last month and the other members such as Italy could look at leaving the EU.

Italy remains defiant on Draghi comments

Over the weekend Draghi spoke more accurately on the risk presented by Italy and their target deficit reduction. Draghi stated robustly that Italian officials needed to ‘calm down’ the budget debate and stop questioning the Euro.

Italy’s government is in a verbal war with the EU over plans to triple their budget deficit next year. The nation’s plans have seen Italian bond yields skyrocket, with the rise compounded by comments from certain Italian politicians which have suggested Italy could be better outside of the Euro.

Draghi has condemned statements from Italian officials on budget expansion, stating they are extremely harmful in a high debt country and have:

Created real damage and there’s plenty of evidence that spreads have increased in connections with theses statements.

Draghi also offered a few wise words of advice to the Italian government which included calming down their tone, waiting for the facts and to analyse in detail their spending plans.

In return Alberto Bagnai who heads up the Italian senate finance committee accused Draghi of agitating market by drawing attention to his opinions, he also said that the opinions on the Euro were not government policy.

When will a European central bank rate rise be implemented?

The ECB has always forecast its first interest rate move to be in autumn 2019, despite the potential of supplementary risk caused by Italy and the trade war this appears to be the central banks aim. This affords the ECB two things; plenty of time to change their policies and an abundant amount of time to see how markets react. Brexit one would hope would be concluded by then and the Italian government should have chosen which route they are taking.

Draghi has always adopted a slow and measured approach and despite some worrying data and some risk which is out of the ECB’s control, the plan will almost certainly be adhered to.

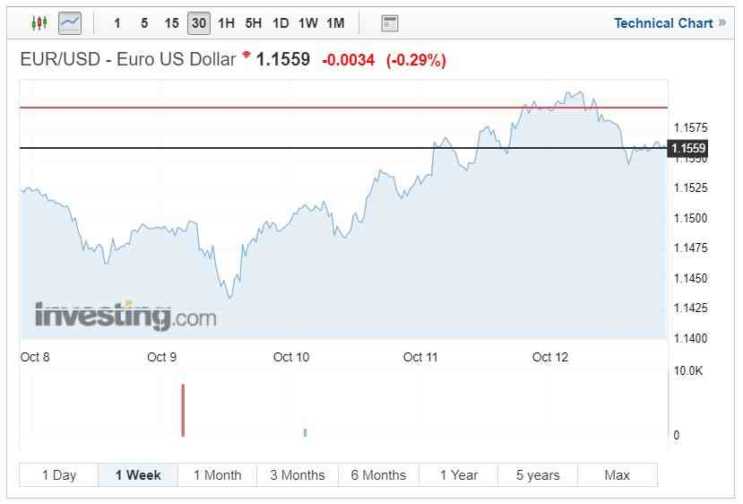

Euro exchange rate reaction to Draghi and ECB comments

The primary pair of EUR/USD has remained in relatively tight range the last few days. Euro did lose roughly 0.3% over Friday’s trading session, it will be very interesting to see how the market reacts to Draghi and Italy’s contretemps next week. The EUR/USD dropped slightly from 1.1578 to 1.1545 following the comments.

GBP/EUR has dropped slightly as fears that the conservative party remain ununified on their approach to the Theresa May’s final stance on Brexit. This saw the currency pair fall from the week highs of 1.1462, closing at 1.1380 down just a touch over 0.3%. Despite this, some investors remain positive that a deal could be struck shortly, and many see the Pound as having the ability to pass the 1.16 level if a deal is struck. It’s understood that negotiators on both the UK and EU sides are now working around the clock to secure a palatable solution. The most likely outcome would be confirmation of a withdrawal agreement and although this could face criticism from certain prop Brexit Tory members investors believe this could boost Sterling.

Euro exchange rate forecast

Appetite for the Euro is at best moderate this week however the single currency has weathered the storm relatively well with EUR/USD trading within a fairly tight range. This week has very few significant data releases which means the most significant news should stem from the EU summit. Although the main headlines will circle around Brexit it will be interesting to see how the news surrounding Italy develops, especially considering the recent stern words from the ECB and the Italian government.

Even the summit will be far from a focus. The dominating focus will be on stock markets and US treasury bonds as investors look to see if the quoted correction will materialise or whether a risk on attitude will be renewed and see investors jump back into equities markets.