Sterling slipped in Thursday’s Bank of England statement, this was despite better than anticipated retail sales and risk-averse investors taking a wider berth on the US Dollar following the very real possibility of a US government shutdown. Much of Sterling depreciation was due to the warning that Carney voiced against the increasing likelihood that the UK would part ways with the EU without a deal, forcing the Bank to revise down its quarterly growth forecast.

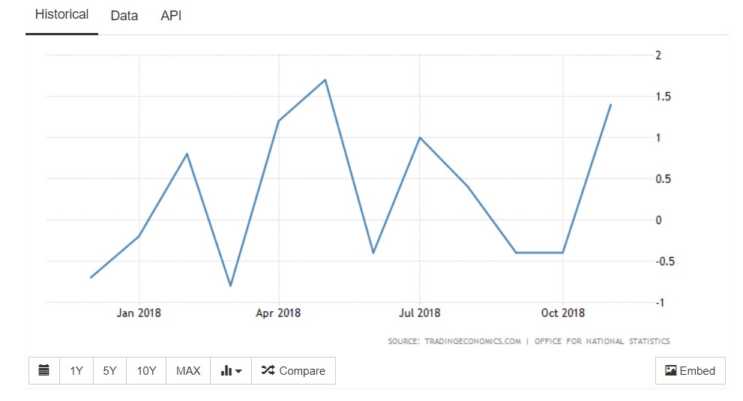

Retail sales

Novembers retails sales came in much better than expected despite two prior negative reads. Novembers estimate of 0.3% was beaten comfortably with the sector showing 1.4% growth fuelled mostly by successful black Friday sales.

Despite the steady decline in the UK high-street, the figures market a triumph, demonstrating that a pre-Christmas consumer spending remains strong. The weekend before Christmas could also bode well for future retail sales numbers with experts anticipating that the UK consumer could splurge another £1.4 billion on the final shopping weekend before Christmas.

Monetary Policy Committee voted unanimously

All nine Monetary Policy Committee members voted to keep interest rates at 0.75% with the committee becoming less confident in the UK economic outlook. Both Brexit and inflation levels continue to dominate the rationale behind rate rises.

Inflation is now believed to be heading below the ideal of the rate of 2% with the fall in oil prices playing a huge part in this. Despite the weaker Sterling, oil prices have traded as low as $53.20 over the last 7 days and have outstripped any fall in Sterling and the BOE now envisages that inflation will fall lower than 2%.

Brexit is now less than 100 days away with the March deadline not long around the corner. The UK still remains in embarrassing disarray, whilst PM Theresa May appears to have support, her plan clearly doesn’t. Labour appears quite willing to sit on the fence and neither supports Brexit or has a viable proposal to table.

The Bank of England won’t have been comforted by the Conservative parties decision to remove the word “unlikely” from the party’s guide on how to prepare for a no-deal Brexit with the cabinet increasing preparations for the no-deal outcome. These preparations even include the drafting in of 3500 troops to assist with contingency plans and disruption.

UK cuts growth forecast

Due to a number of concerns including Brexit, inflation and business investment the Bank of England opted to revise down the UK’s growth forecast. The Bank has always been very transparent about the outcome of a disorderly Brexit and the continual uncertainties surround the UK departure from the EU remains as unknown as ever. Inline with the numerous risks the Bank opted to revise growth down from 0.3% to 0.2%.

Inflation forecasts remain a concern with oil prices seemingly heading only one way. Oil production is currently being ramped up with the US looking to equal production from Saudi and Russia by 2025 and therefore prices should only rise further over the medium term.

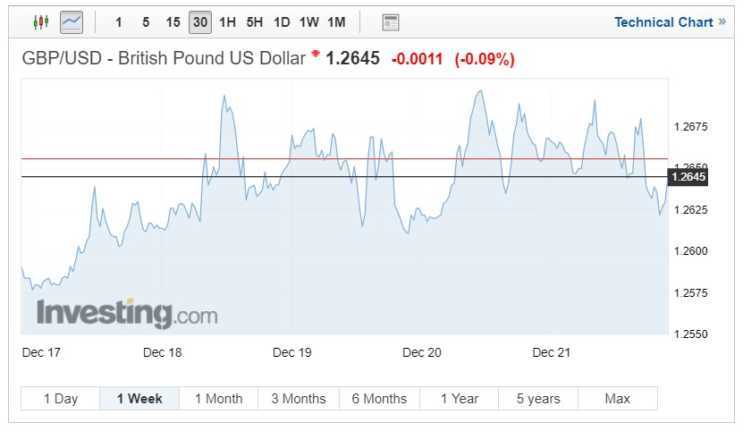

The sterling performance this week

Despite the downbeat outlook from the Bank of England, Pound-Dollar has traded higher this week. Over the last 7 days the Pound – Dollar pair have traded as high 1.2697 steadily increasing from the low opening of 1.2577.

Despite Trump’s threats about the potential government shutdown being a “very long” one, Sterling has gained little in the way of sustained support with either data limiting its progress or the Pound- Dollar pair facing heavy resistance.

Sterling continuously falls short of the 1.27 handle and whilst it occasionally has the legs to challenge this level Pound just doesn’t have the momentum. Whilst the latest retail sales will provide some belief in the UK its limitations lie firmly with Brexit.

Whilst the possibility of amendments to May’s deal provide a glimmer of hope that the UK will avoid a no-deal Brexit the final say will sit with MP’s and with May’s government having far from a majority in Parliament support for her deal seems thin on the ground.