The USD returned to winning ways this week following a period of weakness, assisted by formidable October non-farm payroll number. The greenback correcting some of the losses caused by poor recent macroeconomic data. Recent manufacturing numbers combined with the upcoming midterms and other geopolitical uncertainties had allowed the EUR/USD to prosper from a yearlong low. The US jobs market, both the cornerstone of Trump’s plan and the strong economy needed to correct in order to demonstrate that the US economy still had further room to flourish and underpin recent growth forecasts. It delivered, adding 250,000 jobs to the US economy.

Non-farm numbers buck trend supporting the dollar

The latest bumper US jobs haul added a further 250,000 jobs in October showing that the effects of hurricanes Michael and Florence had been overcome. The US’s habit of providing solid job creation looks set to continue, queue a Trump speech. At its current rate US labour market growth is performing at its highest level ever and will curtail worries that the US labour market is at capacity. Key areas which benefitted from growth in October included; construction, leisure and professional services, demonstration good cross sections of sector growth.

Further records and benchmarks were also met and surpassed this month with the US unemployment rate and average earnings figures.

The unemployment rate remains low and wages look set to increase

The US unemployment remained consistent at 3.7% and marking a sustained 49 year low. The US no able to boast a participation rate of 62.7% with over 60% of the US population now employed in the US.

Accompanying the bumper US non-farms and the low unemployment rate was strong wage growth which is now showing a year on year increase, reaching 3% growth in October. Whilst the long-term effects of the recent us and world market correction remains unpredictable, October’s numbers should add a further level of comfort for risk-driven investors. Household income continues to prosper and therefore appetite for consumer goods should correlate. The labour data will almost certainly provide the FED with further reason to raise interest rates, potentially more aggressively than previously programmed. The news provoking a reaction across markets with US treasury bonds rising, the US dollar rising and stocks falling.

Dollar erases losses following jobs data

Pre the US jobs data the US dollar had weakened slightly due to the resurgence of the GB pound, spurred on by the very real possibility that a deal could be struck this month the GB pound gained nearly 1.9% against the greenback and has held on to its gains well. Closing above 1.30 on Friday.

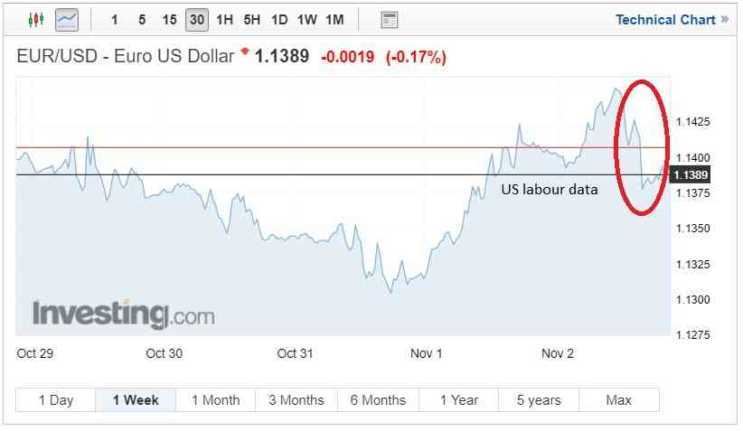

While there was no underlying factor to the recent losses, the mid-terms almost certainly provided a level of uncertainty and combined with the poor ISM manufacturing data could have attributed to dollar losses. EUR/USD touching 1.1449 and being able to haul itself away from a year low of 1.1312. Dollar soon fought back following the latest jobs report which assisted the greenback recovery against the single currency.

EUR/USD falling from 1.1414 to 1.1378 allowing the dollar to claw back much of its lost ground against the Euro.

Although the GBP/USD rate fell below 1.30 closing at 1.2969 a less dramatic movement was seen with the Dollar gaining just over 0.3% against sterling.

It would appear that markets are very much believing that the EU and UK are now firmly set on an agreement, with rumours of a workaround for the Irish border also being discussed.

US dollar forecast

All the time the US economy can sustainably dish out data in the manner it continues to do the USD should continue to strengthen over the mid-term. The next few months will be critical, and a lot of emphases should be placed up the US and Chinese trade talks. If the two parties are able to agree trading terms expect investors to return to riskier assets. However, if no deal is agreed expect equities markets to fall further and the Dollar to strengthen as investors seek out a solid safe haven.