The Australian Dollar fell this week as the RBA slashed its growth forecasts and set the AUD on a downward spiral. Highlighting that a rate cut was more likely than it previous was, the RBA governor set a different tone.

Australian Property prices

During his speech Governor Lowe touched upon the Australian property market stating that consumer spending on property presented the greatest source of uncertainty to the Australian economy. The Australian property market is currently under correction if not disarray. Property inventories remain high and with appetite to invest faltering property prices have begin to fall across Australia, notably in Sydney and Melbourne.

With many believing that the RBA could be months away from an interest rate cut the market could see a resurgence if a rate cut was implemented.

Many might have hoped the Governor would have assisted with a rate cut this month in order to kick start the market, however consumers have been left wanting again with the rate remaining static for the 30th consecutive month at 1.5%. The last rate cut was initiated in 2016 and since hasn’t risen.

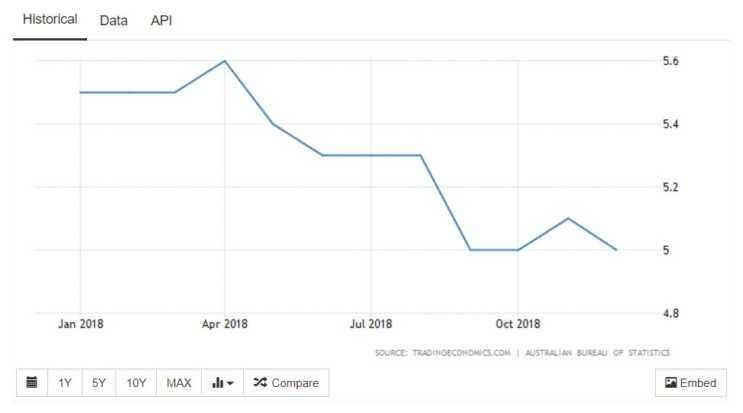

Labour market in Australia

RBA sentiment on near term rate changes will almost certainly be defined by upcoming data including inflation and the labour market. Weak data outcome and missed forecasts will only fuel market belief that the Australian economy is slowing and that a rate cut could be possible.

Despite this Labour conditions remain favourable with unemployment falling to 5.0% in December the lowest level since June 2016. December saw employment climb by 21,600 job posts being filled. On a yearly view full time employment positions grew by 162,000 in 2018, whilst part time roles grew by 106,600.

Accompanying the positive employment and lower unemployment figures the underemployment rate also dropped by 0.1% showing that those with work could manage more hours. All indicating that wage growth could slowly grow, a view which is shared by the RBA.

Interest rates held – future changes could go either way

This month saw Governor Philip Lowe comments move full circle. In previous months Lowe has illustrated that the next rate change would be up, this week however the approach was much more dovish stating that a cut or increase probability is now even. Lowe confirmed that the rate sentiment is now neutral is now neutral and therefore much more closely aligned with overall market sentiment.

Despite this Lowe still anticipates that Australian growth will hit a reasonable level of 3%. This year underlined that uncertainty could be elevated if consumers keep spending whilst property prices fall. Although non-domestic Lowe also cited the global slowdown as another key risk the Australian economy. The previous forecast of 3.25% has been revised down and core inflation is on course to rise to just 2% against a previously forecast 2.25%.

Compounding potential uncertainties, the Federal Treasurer John Frydenberg stated:

“As the Prime Minister and I have warned, there are storm clouds hanging over the global economy, which is why we need to stick to our plan for a stronger economy.”

Many believe that the RBA’s forecasts are still overoptimistic, and investors believe will be revised down further in the coming quarters.

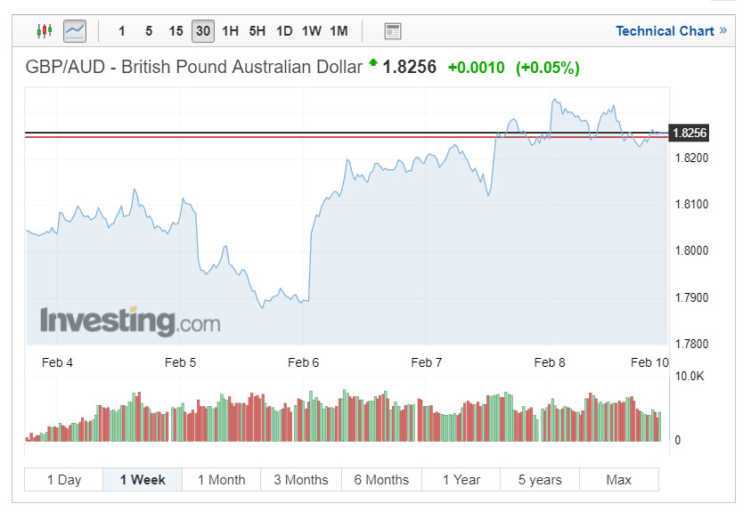

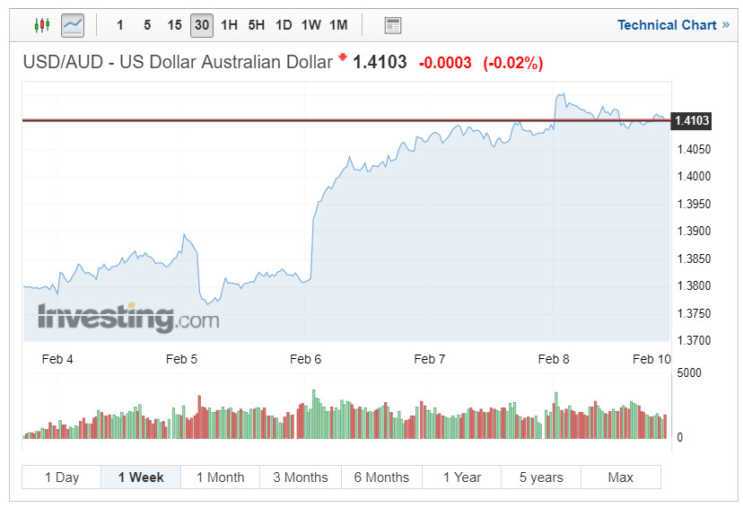

Australian Dollar exchange rate movement

The Australian Dollar fell following the RBA’s growth cuts with the USD/AUD strengthening by just under 0.25% on Friday. The Australian Dollar had been performing well and was amongst the highest performers in 2019 appreciating almost 0.4% in the last few months.

The USD/AUD currency pair appreciating from 1.3815 to 1.324 immediately after Philip Lowe’s statement on the Australian economy’s outlook. The US Dollar enjoyed further gains and closing at 1.4103.

Sterling has also capitalised on the AUD’s weakness with the pair appreciating this week. GBP had appreciated against the Antipodean currency and closed at 1.8256 on Friday encountering a week low of 1.7878 and touching a week high of 1.8328.

Markets anticipate that the AUD is now firmly on the downside and will continue to be sold off. Investors will now look to upcoming data in February with future rate decisions almost certainly being based upon Monetary policy meeting comments, Wage price index and employment and unemployment data all of which will massively influence their next rate decision.